Prosper and other peer-to-peer lenders like Zopa and Lending Club may turn out to be collateral damage from the credit crisis. Yesterday, Prosper suspended new lending in order to register with the S.E.C to create a secondary marketplace for the loans on its site. As recently as Monday, Prosper didn’t think it would have to register as a seller of securities. But the new climate of heightened regulatory oversight in light of the current financial meltdown has changed all of that.

Lending Club previously had to do the same thing and suspend new lending last April . (The S.E.C just gave it the green light to start lending again on Tuesday). Zopa shut down it’s P2P lending site in the U.S. last week.

Even before the increased regulatory scrutiny, P2P lending took a massive hit along with the rest of the financial industry. As Brad Stone points out in an excellent piece in the NYT:

Monthly loan volumes at the company have been declining since the credit crisis worsened this spring. Prosper, which is unprofitable after raising $40 million in venture capital, now faces the damaging possibility that lenders may take their money off the site instead of waiting for the S.E.C. to allow lending to resume. That could take several months.

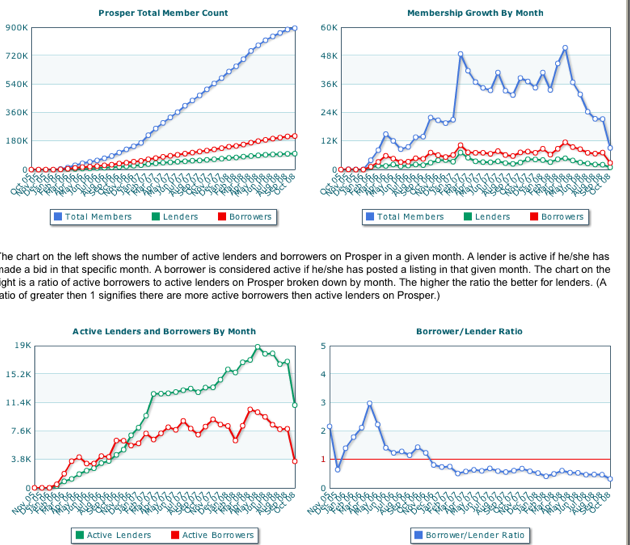

You can see on Lending Stats that Prosper”s membership growth and the number of active lenders and borrowers took a dive starting last April. And delinquencies for loans more than 18 months old are trending at higher than 30 percent. That is because a large portion of Prosper’s loans are in the sub-prime category. People who couldn’t borrow from a bank, borrowed from their neighbors on Prosper instead.

Now they are temporarily shut down.