More evidence that venture exits and fund raising are related. We already know that venture exits were anemic in the third quarter of 2009, and now the National Venture Capital Association has released data on how much money venture funds themselves were able to raise. It was not a lot in historical terms.

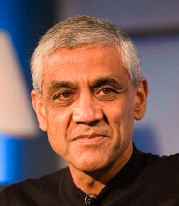

According to the NCVA’s data, venture funds raised $1.6 billion in the third quarter, down 82 percent from a year ago and down 21 percent from last quarter. What’s more is that about $1 billion of that was accounted for by one VC firm, Khosla Ventures. Although, the NCVA only notes Khosla’s bigger $750 million fund, so it is not clear if it is including its smaller seed fund as well in these figures.

The largest new fund in the quarter was Andreessen Horowitz, which is a $300 million fund. But again, the NVCA association only counts $58.5 million. Perhaps that is how much cash they took in and the rest is commitments. But since it is willing to spend up to $50 million per investment, and is participating in the huge round Skype raised, maybe it’s time to call their LPs again. Or maybe, the NVCA’s data is incomplete. Update: Andreesen says it is the latter: “It’s a data glitch related to how the filings work and how the commitments came in — we raised $300 million (exactly — to the penny) for the fund.”

Either way, it is astounding that one or two funds can account for nearly all the venture money raised in a quarter. But perhaps that is function of the fact that not many funds actually raised money. Only 17 funds raised cash in the quarter, compared to 63 a year ago.