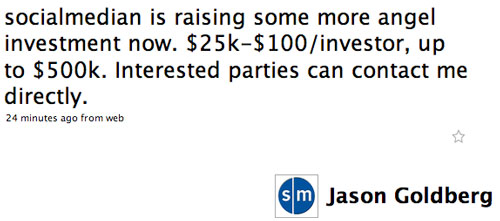

SocialMedian founder Jason Goldberg wrote a Twitter message moments ago letting people know that they are raising a new round of funding, up to $500k, and to contact him if you’re interested. Great way to get investors, right? Exactly not – the whole purpose of the Securities Act of 1933 is to prohibit public offerings like these unless accompanied by a registration statement and a valid prospectus approved by the Securities and Exchange Commission (the fun stuff is in Section 5). The Twitter also violates various state laws.

The good news – enforcement is unlikely, my lawyer tells me. But investors who find out down the road that they’ve lost money are in for a treat – they could almost certainly rely on the offering to get their money back via a rescission right. Of course, by the time they realize they want their money back there may not be any money left to get.

Most venture financings are excluded from Securities Act registration via a private offering exemption. But the key to these exemptions are that they aren’t disclosed publicly and the investors must all be high net worth individuals.

In other words, this is exactly the kind of offering the law is designed to stop in order to protect individuals. I wonder how long the Twitter will be left up.

Update: the message has been removed. A new message says “Deleted the tweet regarding investment. Wasn’t worth the techrunch headache.” Sorry Jason, didn’t mean to rain all over your parade.