Daily deals and local commerce service Groupon has made no secret of its plans to explore strategic options for its holdings in Asia, and it looks like it’s not just Ticket Monster that is on the block. TechCrunch has learned that Groupon is picking up outside investment for Groupon India, and Sequoia is leading the charge with a $20 million stake.

From what we understand, the deal has already been announced to some senior staff but not made public otherwise. The plan is for Groupon India to raise another two rounds of outside funding, one more in 2015 and one in 2016 in a long-term strategy that appears to be aimed at further separating itself from its parent company in the U.S. and growing more autonomous.

A spokesperson for Groupon Inc., Groupon India’s CEO Ankur Warikoo and Sequoia all declined to comment for this story.

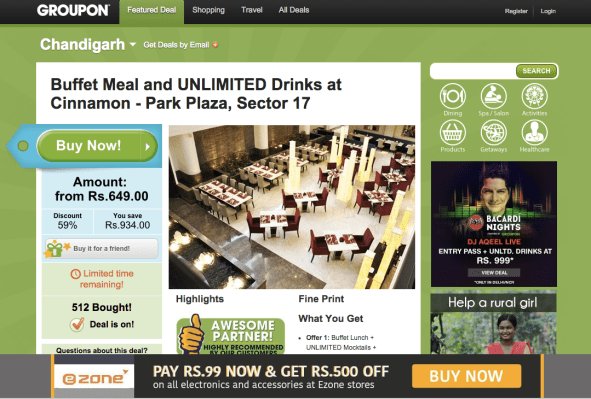

Groupon India was born out of one of Groupon’s first-ever acquisitions: India’s SoSasta, a deal announced in January 2011 and part of the company’s ambitious international expansion strategy. That business first was rebranded as “Crazeal” because of a domain squatter on Groupon.in. Eventually, Groupon regained its brand in the market.

But brand was only a small part of the battle. One of the issues, faced by many businesses that grow by acquisition, is that it can be a challenge to run operations for e-commerce businesses when they are not centralized on a common platform, not just when it comes to day-to-day reporting but also when the business wants to roll out new tech or new services.

And without the same kind of investment that Groupon is making in operations closer to home, the business has not been a blockbuster for the company. India does not get broken out in Groupon’s balance sheet, but in its last earnings, the rest of world segment accounted for only $101 million of the company’s $925 million in revenues, and Groupon noted that Ticket Monster accounted for a large part of revenue growth (but also losses) in the region. As a point of comparison, a year before, when there was no Ticket Monster, rest of world reported $74 million in revenues out of a total $768 million.

At the same time, e-commerce has become a very hot property in India. Companies like Snapdeal and Flipkart are among those that are collectively raising billions to meet demand from a rising middle class of consumers in the country ready to buy goods and services online or by mobile. With Snapdeal pivoting a couple of years ago to become a marketplace for the sale of online goods, Groupon India has hopes that its continuing focus on local commerce offers something differentiated to the market, and that investors will think so, too.

Sequoia has stood out as a key investor in India. According to CrunchBase, the VC is the all-time leading investor in the country in terms of number of deals. In 2015 so far, Sequoia-led deals have accounted for 12% of all Indian startup venture rounds and 33% of capital raised by those startups in 2015.

Groupon has admitted that it is looking at options for its Asia business, not just Ticket Monster.

“The company announced… that it is exploring a range of financing and strategic alternatives for its Asian businesses, including Ticket Monster. As part of that process, multiple parties have expressed preliminary interest in Ticket Monster, although it is too early to comment on structure, pricing or the likelihood of a transaction, as the process is still underway,” the company noted in its last earnings report.

Excluding Ticket Monster, rest of world was near break-even in the quarter, it said, compared with a $14.7 million segment operating loss a year ago.

It’s also not the only one rationalising after fast international growth. Longtime competitor LivingSocial, which had actually sold the Ticket Monster business to Groupon in November 2013, last month sold Let’s Bonus, its last international, non-platform business, in a management buy-out.