![]() More and more startups are finally focusing on real business models, ones that are based on actually selling a product or service. You know, for money.

More and more startups are finally focusing on real business models, ones that are based on actually selling a product or service. You know, for money.

The irony is that many get pretty far down the development path before realizing that adding billing infrastructure to their offering may not be as simple as integrating with PayPal’s API or some other payment processor.

Choosing the right processor, and many times, processors, from a confusing multi-layered vendor ecosystem can be tricky. Poor decision-making when it comes to issues such as terms of pricing, business fit, or processing capability, can each be a deep gash in any startup’s soft underbelly.

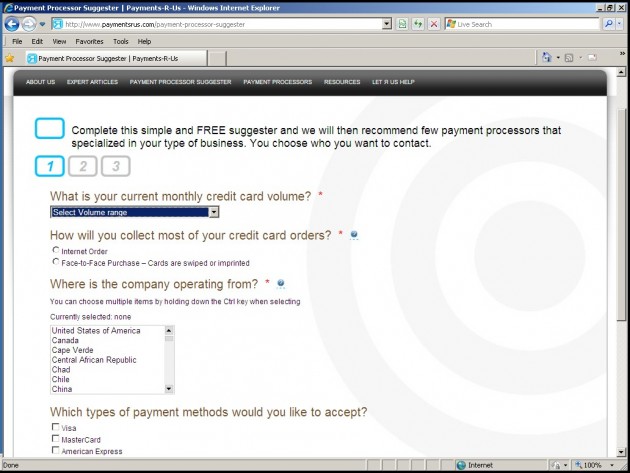

Payments-R-Us is trying to alleviate the confusion by providing a payments vendor-to-merchant wizard that makes it a snap to choose the right payment processor. The wizard is supplemented with some in-depth content aimed at educating merchants to better grasp the ins and outs of the terms and options offered by vendors so they can better negotiate agreements.

The Payments-R-Us wizard covers four major verticals: traditional US, international, digital goods and high risk. There are currently 15 processing services listed (including several from Amazon, PayPal, and Google Checkout), with about a dozen more in the pipeline. CEO Michael Shatz stresses that most are considered ‘Tier 1’ processors, defined by the fact that they are listed in the top 50 of the annual Nilson Report on top processors.

The wizard is pretty thorough and will walk a merchant through a selection process that includes such options as multi-currency support, affiliate marketing, digital content, eCommerce hosting, alternative payments, as well as adult and gaming.

Payments-R-Us’ business model is a fairly simple one: affiliation. It gets a commission for every merchant it refers to a vendor. Does the fact that Payments-R-Us earns a commission impact its objectivity? I don’t believe so. One of the founders and investors in the company is Yuval Tal, Founder & CEO of Payoneer, which we’ve previously written about (here & here). By all accounts, Tal is considered a stand-up entrepreneur in the Israeli startup community.

Payments-R-Us won’t be a billion dollar business. But it serves a real need and has a clear hook for a business model which I imagine could run revenues up to six-figures per month. Its only challenge will be to situate itself as a key destination for merchants when making their processing vendor selection.