People often compare market capitalization (current share price times the number of shares outstanding) for public companies as an indicator of success / failure, and one surpassing the other as a sign that one is overtaking the other, regardless of whether they’re actually full-fledged competitors or not.

Google and Apple, for example, have been making headlines when stock transactions move their respective market cap to top the other company’s (see this Bloomberg article from August 2008 or this one from GigaOM from two weeks ago).

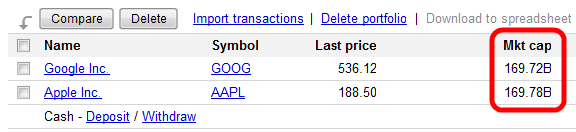

So here’s a fun fact to start off the week with: the market cap for both Google and Apple are currently tied at about $170 billion after Friday’s market close.

Google closed at a share price of 536.12, while Apple’s closed at 188.5 but with nearly three times as many shares outstanding. To the investment community, the tie in market cap means the companies are exactly the same size today (the measurement is an important indicator of the value and size of a company and thus a determining factor in stock valuation).

Both companies beat analysts’ estimates when they announced their latest earnings earlier this month (relive our coverage of Google’s Q3 earnings announcements and Apple’s Q4 results). It will be interesting to see how both stocks keep performing as we continue to slowly but surely crawl out of the recession.

And just for the sake of comparison: Microsoft’s market cap is currently approximately $246 billion, while IBM’s is $158 billion and Yahoo’s closed last week at $22 billion.