http://widget.icharts.net/icharts.swf

More venture dollars went into startups in the third quarter than the two previous quarters of the year, but was still down 33 percent from a year ago, according to the latest MoneyTree report put out by PricewaterhouseCoopers and the National Venture Capital Association. The report counts 657 venture deals worth a total of $4.8 billion, up 17 percent from the second quarter.

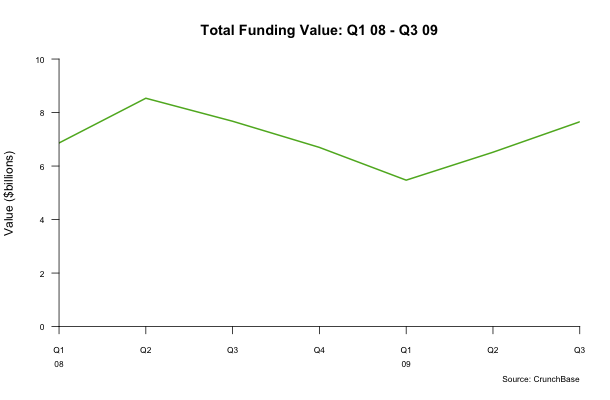

We found a similar rise in venture dollars (up 17.5 percent) in our third quarter TechCrunch Trends report. Although, we measured a higher dollar-volume of deals—$7.7 billion in aggregate venture funding across 645 funding rounds. (We also came out yesterday with a ranking of the top 25 most active VC firms).

The MoneyTree report also marked a rebound within the Internet and Clean Tech sectors. Venture dollars going to Internet startups was up 42 percent from the second quarter to $843 million. Clean tech dollars were up an even greater 89 percent to $898 million, from the previous quarter.

On an annual basis, Internet dollars are still down 22 percent and clean tech dollars are down 14 percent from the $1 billion quarterly levels they were at a year ago.

Again, comparing our numbers from CrunchBase to the MoneyTree numbers (which come from Thomson Reuters), we count the same number of clean tech deals (57), but capture more of the dollars going into those deals ($1.98 billion). To be fair, part of that difference is because we also count federal grant money going to clean tech startups. Also for Internet deals, which we define differently, CrunchBase measure 274 deals worth $1.6 billion, versus 148 deals. The full list of deals is in our $295 report.

Here are some more charts from MoneyTree.

Clean tech deals

http://widget.icharts.net/icharts.swf

Internet deals