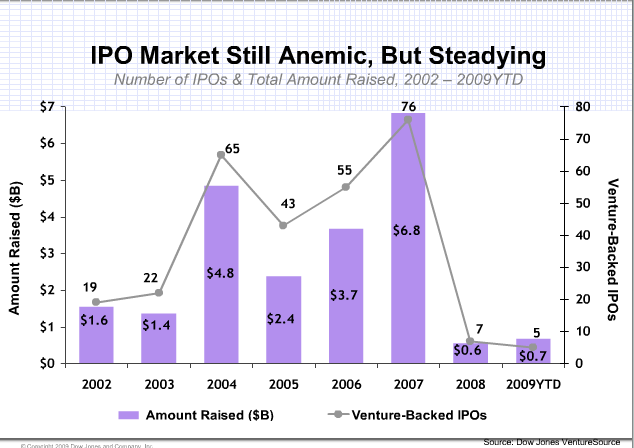

Despite a couple large IPOs (LogMein and A123Systems) and a steady but tempered flow of mergers and acquisitions, financial exits for venture-backed companies remained anemic in the third quarter of 2009. Data released by both Dow Jones VentureSource and the National Venture Capital Association/Thomson Reuters show declines in both M&A and IPO dollars. VentureSource counts $2.9 billion in combined M&A exits in the third quarter, 49 percent lower than a year ago. The NCVA tallies up a $1.8 billion total, which is down 46 percent.

The two organizations have different sets of data, but they show similar trends. For example, VentureSource counts only the two IPOs mentioned above, whereas the NCVA also counts Cumberland Pharmaceuticals. That’s down from five venture backed IPOs in the second quarter.

IPOs Down

http://widget.icharts.net/icharts.swf

The IPO for battery-maker A123Systems last week was particularly strong, raising $380 million. LogMein’s IPO at the very beginning of the quarter raised $107 million, and Cumberland’s brought in $85 million, for a total of $572 million. That amount is down from the $720 million venture-backed IPOs brought in last quarter, but is up from the $188 million a year ago. Compared to year’s past, though, the IPO window is still fairly shut.

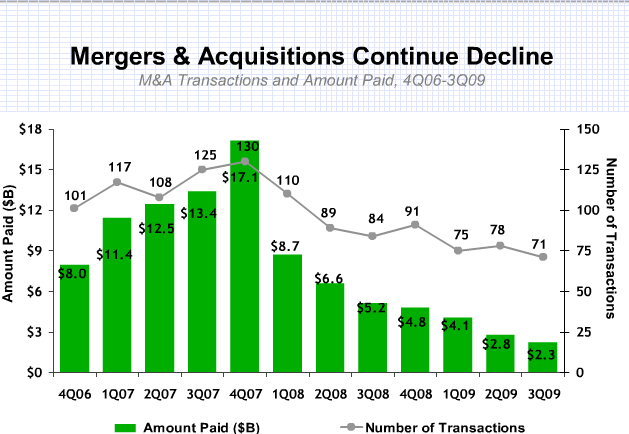

The M&A picture wasn’t much brighter in the quarter. VentureSource tracked 71 deals worth $2.3 billion, down from $5.2 billion last year and $2.8 billion in the second quarter of this year. Some of the larger deals during the quarter were VMWare buying SpringSource for $362 million and Intuit buying Mint for $170 million. (Remember, these are only venture-backed exits. Deals for publicly traded companies like Adobe buying Omniture for $1.8 billion, Dell buying Perot Systems for $3.9 billion, or Xerox buying Affiliated Computer Services for $5.75 billion are not counted in these numbers).

The NCVA’s data shows 62 M&A deals in the quarter (down from 88 a year ago), with disclosed values of $1.2 billion (down from $3.1 billion a year ago). And the returns aren’t looking so great either. VentureSource says the median acquisition price in the third quarter was $21 million, compared to a median amount of $17 million in equity funding raised prior to the acquisition.

The NCVA similarly shows a decline in average deal size from $96 million a year ago, to $58 million. And the number of deals worth less than the money put into them is more than the number of deals that made money, which is normal.

Average M&A Deal Size Drops