37signals founder Jason Fried probably had the post of the day today mocking Twitter’s $1 billion valuation on its latest rumored round of funding. The post, titled “PRESS RELEASE: 37SIGNALS VALUATION TOPS $100 BILLION AFTER BOLD VC INVESTMENT” is very funny. But it’s also disingenuous.

37signals founder Jason Fried probably had the post of the day today mocking Twitter’s $1 billion valuation on its latest rumored round of funding. The post, titled “PRESS RELEASE: 37SIGNALS VALUATION TOPS $100 BILLION AFTER BOLD VC INVESTMENT” is very funny. But it’s also disingenuous.

By way of sarcasm, Fried raises a number of points. But the key ones he hits on are valuations, revenues (or lack thereof), business models, and hype. And he chose an easy target in Twitter, which has no shortage of naysayers who simply cannot believe the amount of funding and valuation the service keeps getting. But Fried undoubtedly knows how the game is played, and by picking on the current “it” company, a few people noted that his post looked more like a case of sour grapes. But his points are still definitely worth talking about.

Valuations

Fried jokes that 37signals is valued $100 billion based on a group of people who are paying $1 for 0.000000001% of the company. His point is that valuations based on investments are ridiculous. But that’s not entirely true.

Certainly some are — Microsoft’s investment in Facebook that pumped its valuation to $15 billion is a great example. But the key point there is that Microsoft wasn’t making an investment in Facebook hoping to get rich when the company eventually has an exit. Rather, it was making a small (1.6%) strategic investment mainly to keep Google away. At the time, everyone went mad over the $15 billion number, but it was never realistic to begin with. Since then, Facebook (which has grown a lot in size) has raised real money at valuations that are much less. So did Microsoft get screwed? No, because it was never about the money.

But in Fried’s example, lets assume that the $1 investors are putting money in hoping to eventually get it back. If they really are paying $1 for 0.000000001% of the company, putting the valuation at $100 billion, those investors are going to want an exit of more than $100 billion (leaving out the various types of deals and options they could have surrounding an exit). So that $100 billion number does have meaning.

And likewise, without knowing the details of its latest round, the $1 billion number probably does have meaning for Twitter. If an when it closes this latest $100 million round, those investors are going to be looking for an exit of more than $1 billion. You can bet that T. Rowe Price wants to make money on this deal, as do the firms involved. And they clearly think Twitter is worth more than $1 billion dollars. And they’re hardly alone.

Revenues & Business Models

Fried jokes, “In order to increase the value of the company, 37signals has decided to stop generating revenues.” And continues, “Once you have profits, it’s impossible to just make stuff up.” That is absolutely true, and Mike wrote a great post recently about that very dilemma Twitter could well face shortly.

But this is Fried pulling out the tired “Twitter makes no money” card. Let’s be clear: If Twitter wanted to right now, it could make money. (Well at least revenue, if not profits.) They would simply have to turn on advertising (which they can now do thanks to a recent change in their TOS) and some amount of money, and probably not an insignificant amount, would start rolling in.

At the same time, if it did that, investors would have a better idea of their business potential and that could make some wary of sky-high valuations if the numbers weren’t stellar — which both Fried and Mike rightly note.

But as Twitter has stated numerous times, its real intention for making money (at least right now) is not to go the way of ads, but instead to do professional accounts and tools. It would seem that Twitter is getting closer to rolling that out, and they’ve said the plan is to start making money before the end of this year. We’re closing in on that, so it seems safe to assume that new investors have a pretty good idea of Twitter’s strategy here. And if that’s the case, they clearly like what they see enough to pour in $100 million (again, assuming that round closes).

With this rumored new round, Twitter would have some $130 million in the bank. Like Facebook before it, that would give the company plenty of time before they had to start making any meaningful amount of money. Actually, Facebook just this past quarter went cash flow positive for the first time — after taking over $700 million in funding throughout the years. Twitter seems downright svelte by comparison.

The point is, they will have plenty of cash, and as such, plenty of time to worry about getting the right business model in place. And these investors would not be investing if they didn’t think that would happen, obviously.

Hype

“Bhatnagar admits the math [for valuations] is mostly a guess but points out that ‘the press eats it up.‘,” Fried writes. That’s undoubtedly true, we the press do eat this stuff up. Big numbers are sexy, and lead to interesting, or at least lively, discussions. But again, this is Fried suggesting that valuations based on investments are crazy. In some cases, they are, but not always. And provided that both the writer and reader understands how they work (which, admittedly, is quite often not the case), they can be a useful point of reference.

“37signals will lead the new global movement filled with imaginary assumptions on growth and monetization potential,” he continued. “We’re excited to roll out a list of unconfirmed revenue possibilities that involve crowdsourcing, a robust set of widget creation tools, 3G, augmented reality, social stuff, and an app store. Also, everything we make will include a compass,” Fried concludes.

Though he later backtracked from it, it seems pretty clear that Fried is suggesting that Twitter is pretty much all hype. We touched on this a bit yesterday, but ultimately, this still remains to be seen. But what’s humorous is that on the sidebar of his very post, Fried himself has a Twitter widget, and it’s actually above his list of 37signal products. This isn’t quite as bad as the people who loudly proclaim that Twitter is all hype — on Twitter.

But regardless of where you fall on the hype debate, all that really matters is that the investors obviously don’t think it’s hype. And they’re apparently still pouring money into it with the belief that it will be the next big thing. How big? Big enough to have an exit north of a billion dollars. How do I know? The valuation told me.

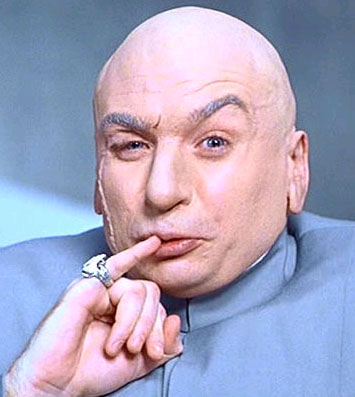

[photo and video: New Line Cinemas]