What do entrepreneurs want from venture capitalists? A new Cornell study by Ola Bengtsson (now an assistant professor of finance at University of Illinois Urbana-Champaign) and Frederick Wang looked at the stated preferences of entrepreneurs as expressed in comments and ratings on VC-ranking site The Funded. The study, which is based on opinions from roughly 1,500 entrepreneurs about 526 U.S. venture capital firms, tries to assess what they value the most from VCs.

In general, entrepreneurs view independent venture capital firms more favorably than strategic, corporate, or government VCs. They do a pretty good job of identifying which VCs have the best track record (which Bengtsson checked against VentureEconomics data), but just because a VC has a good financial track record doesn’t mean he or she will be the most helpful. And one of the things entrepreneurs value the most from a VC is quick feedback (positive or negative) when they are doing due diligence because time is money, and startups don’t have much of either.

Bengtsson shares some of his conclusions:

1. Entrepreneurs can correctly identify which VCs have the best historical track record but they do NOT perceive these investors to be more able to add value pre- and post-investment. This result is surprising but found in my analysis of more than 1,500 unique entrepreneurs and 500 VCs.

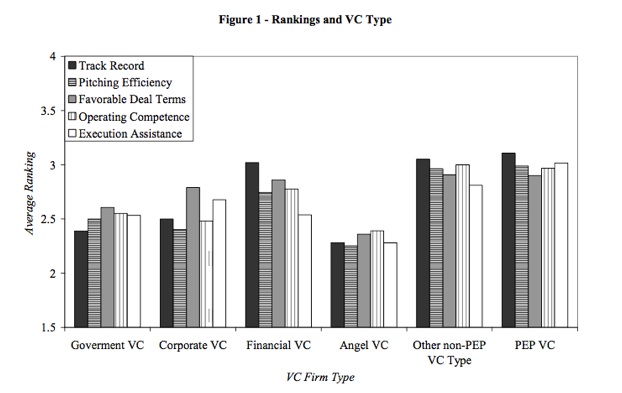

2. Entrepreneurs view private partnership (independent) VCs more favorably than other VC affiliated with corporations, financial institutions or government agencies. Thus, independence is good.

3. Entrepreneurs who have interacted with more VCs have a less positive view of these investor’s ability to add value pre- and post-investment. This suggests that entrepreneurs learn over time that each VC is less unique and useful.

4. Entrepreneurs like when VCs conduct fast due diligence and give feedback on the business plan. Time is a scarce luxury when you run a startup.

5. Many entrepreneurs express concerns that some VCs have tensions within their organization/partnership. The entrepreneur may like the VC partner he meets but turns down the VC because of potential internal conflicts.

Bengtsson admits that there is a potential for selection bias in his study since the data comes from entrepreneurs who choose to be vocal about their opinions on The Funded. But he also points out that “they at least reflect how an important population of entrepreneurs evaluate the VCs they have encountered” and that when he dug into the data he didn’t find an unusually negative or positive bias. More importantly, the study tries to make conclusions about how preferences differ for different types of VCs. If The Funded attracted overwhelmingly negative entrepreneurs, that wouldn’t explain ehy they prefer independent VCsand private equity partnerships (PEPs) over corporate VCs or their ability to correctly asses a VC’s track record. The study is embedded below.

http://viewer.docstoc.com/

What MAtters In Venture Capital? –