Time Warner released it second quarter results today, and the numbers aren’t good. Overall, revenue was down 9% versus the year-ago period as poor results from the publishing, film and yes, AOL dragged down the numbers for all. CEO Jeff Bewkes remarks are telling:

Time Warner released it second quarter results today, and the numbers aren’t good. Overall, revenue was down 9% versus the year-ago period as poor results from the publishing, film and yes, AOL dragged down the numbers for all. CEO Jeff Bewkes remarks are telling:

At the same time, we’re continuing the reshaping of Time Warner that we started last year. We’re on track to spin off AOL to our stockholders around the end of the year. Separating AOL will benefit both companies – enabling Time Warner to concentrate fully on our core content businesses and improving AOL’s operational and strategic flexibility.

That’s three AOL mentions in three sentences. Clearly, Time Warner is happy to let everyone know that it will only have a couple more quarters of dealing with that division’s nosedive.

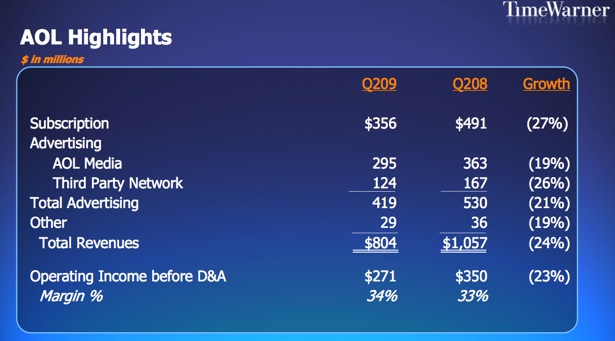

How bad was AOL this quarter? Revenues dropped 24%, to $804 million, versus the year-ago period. The service saw a 21% decrease in advertising revenues, attributable to both display and search ads on its own sites, as well as on third-party sites using its platform.

And the loss of dial-up subscribers continues to hurt the company. It lost over a half million in this past quarter, and some 2.3 million from the year-ago period. Revenues from subscriptions declined 27% from the year-ago period.

In preparation for the AOL spin-off, Google recently sold back its 5% stake in the company, at a $700 million discount from its initial $1 billion investment. However, thanks to the search deal over these past several years, it looks as if Google was much closer to break-even on the deal.

And while AOL’s numbers were awful, Time Warner’s print and film divisions hardly fared better. The print division headed up by Time, saw a 26% decrease in ad revenue from the year-ago period, and an 18% decrease in subscription revenue.

Meanwhile, the film division was hurt by the slide in DVD sales. While movies like The Hangover exceeded expectations at the box office, those profits were wiped out by DVD numbers being down across the board.

Highlighting The Hangover in the results is interesting. One could say Time Warner’s experience with AOL these past several years after the $164 billion mega (or perhaps “drunken”) merger in 2001 (remember, it was AOL that actually bought Time Warner at the time), has been similar to The Hangover. Based on the repurchasing price Time Warner paid for Google’s AOL stock, AOL is now worth less than $6 billion.