Friendster, one of the oldest social networks, is actively looking for a buyer and has hired investment bank Morgan Stanley to find a party interested in acquiring the company or at least some of its assets.

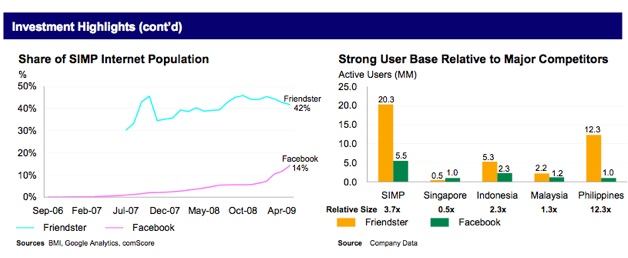

According to documents obtained exclusively by TechCrunch, it looks like Morgan Stanley is shopping Friendster around in Asia, which makes sense considering almost its entire user base is located in the Asian-Pacific region. In the main document (embedded below), it says that 75 percent of its registered accounts are in Asia. The docs come from a credible source, are time-stamped ‘July 2009’ and carry a number of interesting nuggets about the influence Friendster still has in the social networking sphere, even if mostly in Asia.

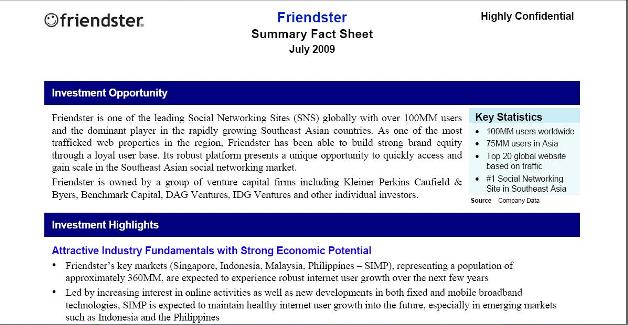

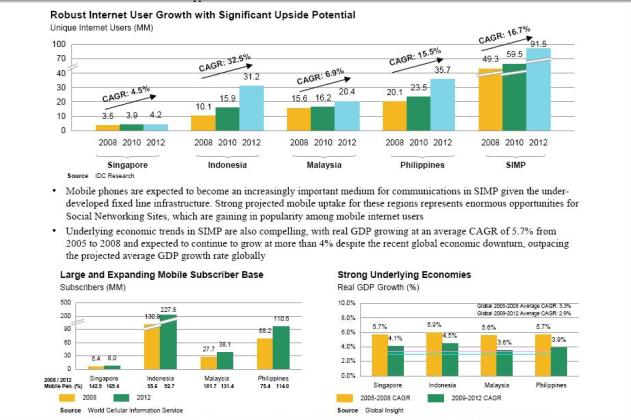

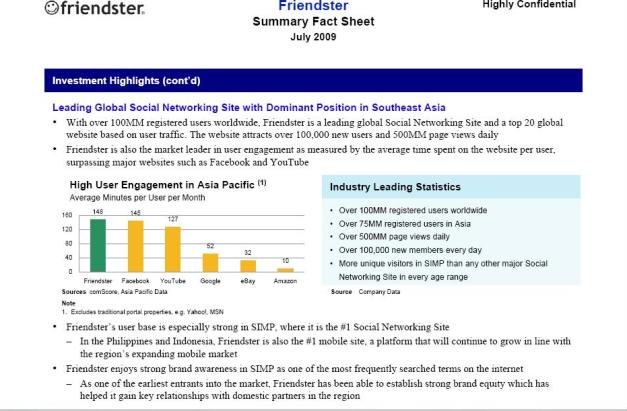

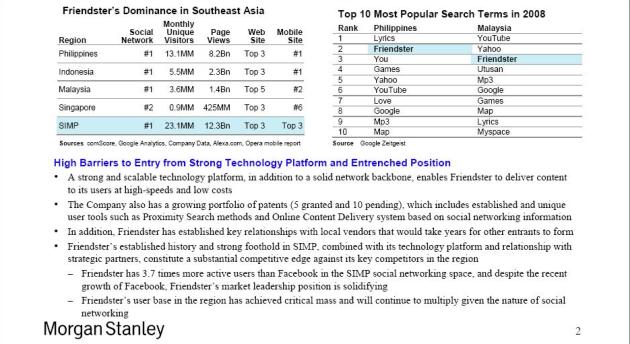

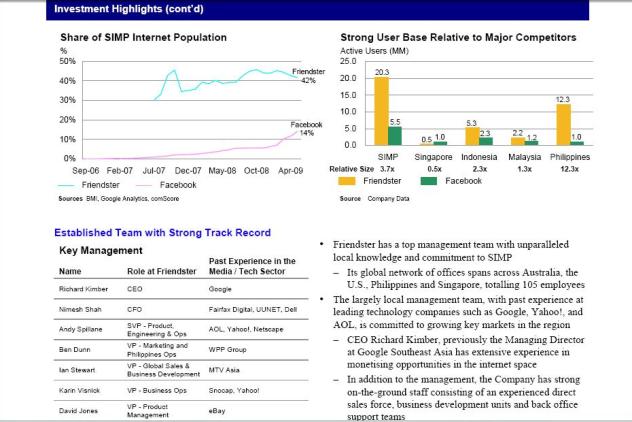

In the summary fact sheet being sent to multiple potentially interested buyers, Friendster claims over 100 million registered users globally and touts its stronghold in the Asian-Pacific region as well as a bright future ahead since a number of its key markets (Singapore, Indonesia, Malaysia, Philippines, aka SIMP) are expected to experience robust Internet user growth over the next few years. The fact sheet also says Friendster attracts over 100,000 new users and 500 million page views on a daily basis, making it a top 20 global website based on user traffic. According to the documents, the company currently has an employee headcount of 105 employees spread out across its global network of offices (Australia, the United States, Philippines and Singapore).

The fact sheet that we obtained shows that Friendster/Morgan Stanley are gunning for a buyer who wants to gain quick access to the Asian social networking scene, emphasizing it would be hard for newcomers to establish themselves given the relationships with local vendors and partners that are needed for such a venture to become a success. Additionally, it touts Friendster’s portfolio of patents in the space (5 granted and 10 pending) and its experienced management team.

More interesting nuggets of information: Friendster is looking to expand its current revenue streams to include—besides online advertising—virtual goods, gaming, surveys, dating, music and classifieds.

One thing we couldn’t gather from the documents, which are embedded below, is the price Friendster is hoping to get. The company is backed by more $45 million in capital venture firms like Battery Ventures, Benchmark Capital, DAG Ventures and Kleiner Perkins Caufield & Byers, along with some early angel investors such as LinkedIn founder Reid Hoffman and Spinner/Grouper founder Josh Felcher.

Our latest model valuing social networks puts Friendster at only $210 million, based on Facebook’s recent valuation of $10 billion. Mostly that is because of the lower spending power of consumers in Southeast Asia, making advertisers value them less differently. That $10 billion Facebook valuation, though, was for preferred shares. If you look at the $6.5B valuation of the most recent sale of common stock, Friendster would be worth only $137M in comparison. Back in 2002, the company turned down a $30 million buyout offer from a pre-IPO Google. (In an interesting twist, Friendster’s current CEO, Richard Kimber, used to head up sales for Google in South East Asia).

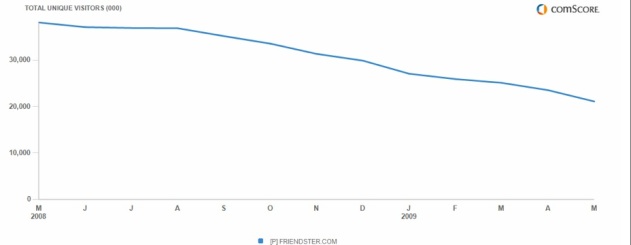

We also took a look at the comScore numbers for Friendster in May, 2009 compared to the same period last year, and worldwide unique visitors dropped 45 percent to 21 million (suggesting there is a big difference between active and registered users).

With stats like these, no wonder the company and its investors are looking for a way to cash out.

Also amusing was that a quick search on Twitter turned up mostly messages from US-based users that were deleting their Friendster accounts.

And here are (screenshots of) the documents:

http://viewer.docstoc.com/

PJ Connect – Potential Purchaser CA –