Interesting off hand comment by AOL CEO Tim Armstrong at the Fortune event this morning. Bebo, the social network AOL paid $850 million for in 2008, wasn’t mentioned on the list of AOL’s core product goals going forward. Late in the interview, though, Armstrong was asked where Bebo fits into that strategy. His answer, roughly quoted “Bebo may be better off under AOL Ventures, with it’s own P&L.”

Translation – AOL is looking to spin Bebo off into an independent company, and they’ll retain an equity interest via AOL Ventures.

This is pretty much in line with what he told Erick during an interview last week. During that interview he distanced himself from the acquisition: “I was not here during the acquisition of Bebo. Social networking was an unclaimed category, and growing quickly.” The reason he placed it in AOL Ventures is so that it can “focus on improving the consumer product,” he said. Armstrong added that one of the purposes of AOL Ventures is “to keep things on track that have not been on track. ”

But he noted that there is another purpose for AOL Ventures as well. In areas where product synergies “have not been realized, it gives us an opportunity to take it out of AOL, to make it groomed, and maybe attract outside investment.” It was pretty clear he was talking about Bebo.

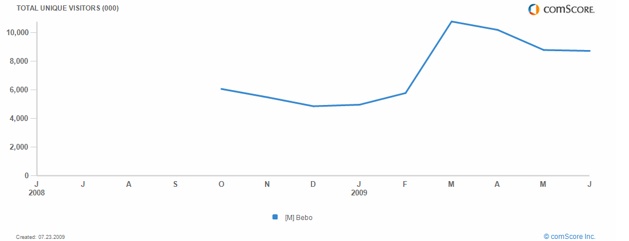

AOL acquired Bebo in early 2008 for $850 million. But the property has languished since then and it has not been integrated much at all into AOL proper. Bebo had 8.7 million unique visitors in the U.S. in June, 2009, 20 percent down from its peak in March, 2009 (comScore). Globally, it is holding up better, with 24.2 million uniques in May, 2009 down 12 percent since March, 2009. But if Facebook is worth $6 billion to $10 billion, Bebo might still be able to get a decent valuation if it can hold onto its users.