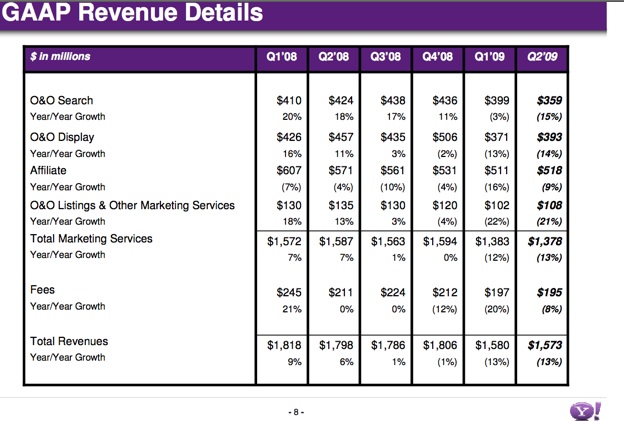

Yahoo just released earnings for the second quarter. Total revenues dropped 13 percent to $1.5 billion. Google, in contrast, saw total revenues rise 3 percent in same quarter. After paying partner sites traffic acquisition costs (TAC), Yahoo’s take-home revenue was $1.1 billion.

Yahoo’s net income rose 8 percent to $141 million. Operating income fell 17 percent to $101 million, and net income fell a whopping 78 percent to $118 million (but much of that difference was due to a $401 million non-cash gain Yahoo took in the first quarter related to its stake in Alibaba, which had an IPO).

Yahoo’s search advertising revenues on Yahoo-owned sites declined 15 percent to $359 million, while display advertising on owned and operated sites declined 14 percent to $393 million. Yahoo announced a deal with AT&T to sell local online ads.

Correction: This post briefly included information about layoffs which was incorrect. My apologies for alarming any Yahoo employees.

During the conference call, CEO Carol Bartz praised Bing (Microsoft’s search effort) and promised to get rid of annoying ads on Yahoo Mail. My live notes are below (bolded parts are for emphasis):

Carol Bartz:

Considering the economy I am pleased with our results, revenues above midpoint of our expectations, upside coming from currency fluctuations.

Less fear from advertisers.

But so much conflicting info form the market, too early to call.

1. great team (hired CFO)

2. great experience (mobile, social, advertising) have to make sure ads are more relevant, less irritating to users.

3. Better business processes. Want to be a better company to work for and with.

CFO Tim Morse:

Pageviews up 7%

Rev: $1.573 billion (down 13%)

Search revenues down 15%

display revenues down 14%

encouraging sign: guaranteed display inventory increased on a sequential basis

growth in health and travel

Affiliate business (primarily search) down

TAC was 28% of total revenue, rising slightly

listings revenue down 21%

OCF (operating cash flow) $385M

free cash flow $266M

savings at the low end of our expectations due to cost savings. Planning on hiring new sales people, invest in branding efforts to seize growth opps that will come as economy recovers.

$365M restructuring charge, real estate related and $25M related to headcount reduction

$67M pretax gain from sale in Gmarket.

Carol Bartz:

Biggest content site. Lead in news, sports, finance, and other categories. Yahoo homepages leads all others.

brags about a single link from Yahoo home page to NYT, creating 9M pageviews.

“We work with publishers, not against them” (subtle dig at Google)

Yahoo mail, open features, improvements in speed and performance and engagement.

Talks about annoying ads, calls them a “detriment,” “cheapening the Yahoo brand.” Will be trying to get rid of blaring ads.

Initiative around improving ad experience

Talks about mobile search deal with cell phone carrier in Taiwan to displace Google [she’s digging deep there]

expanded relationship with AT&T to sell Yahoo local inventory by AT&T advertising salesforce. Yahoo’s salesforce with its advertising partners is now 13K strong.

Q&A:

Q: Carol, what is your first impression on Bing? Seeing any user behavior changes?

Carol: I think Bing is actually a good product. Experimentation around search instead of thinking just a standard blue link. only a month in, hard to understand if it is just curiosity or if they will gain share, but I think they have done a nice job.

Q: Search business seems to have deteriorated, display shows sequential improvement. Where is the bets ROI, display or search, since you will prob. have to choose one or the other?

Carol: Search did decline Q over Q, that is not a meaningful trend. Our volume was healthy, more that there was RPS pressure. The whole idea is to keep to optimize and drive relevancy for advertiser’s ROI. Advertisers being smarter, chose less keywords.

At the end of the day, our investment priority is in the user. If we can increase our audience, which we know we can, we can drive both search and display revenues. We can provide both, but what we really need to provide ad partners is an engaged audience.

Tim: CPCs not that different, more a mix in the queries.

Q: Do you get renumerated for links to Facebook or Gmail?

Carol: No, it is really about giving consumers an experience on Yahoo without having to leave Yahoo. To be the center of their online life. Not about money, about helping them organize their online life.

Q: Ebitda margins lowest guidance since 2003. You said you would be ramping spending in Q, how should we think about margins?

Carol: When we gave the guidance last Q we told you we were going to to layoffs to have room to put the same cost into the system to reinvest into the business. Pretty much on target with that. Marketing spend for 3Q is in the additional cost already ($75M?). Adding people into product, engineering, sales people.

Tim: Repositioning cost structure, drained some buckets, now filling up different buckets.

Q: What percentage of ad inventory is guaranteed? How should we think about yearly cost structure?

Tim: We don’t break out between guaranteed and non-guaranteed. We did see strength in guaranteed in high-single digits. Strength in 7 out of 10 categories we track like finance, health, consumer products. In non-guaranteed ads, more steady.

Carol Bartz: It’s like 30 to 40 steps to buy a display ad from us. Want to have a much. much easier way to do business with us. Looking forward to making this better.

Q: How is growth in Q2 breaking down?

Carol Bartz: We don’t actually break this out, but there are those people experimenting more with non-guaranteed and new customers coming in with guaranteed. By moving more into the mid-market that will be a lot more non-guaranteed because that is their first online ad experience.

Tim: We are doing very well with our top advertisers. On Display, revs are up with top ten advertisers. Also in Search, but not quite as good.

Q: O and O search vs. affiliate revs?

Bartz: I don’t see a trend.

Q: U.S. was down, looks like RPS (revenue per search) pressure, is that because of scale vs. Google?

Bartz: Of course scale matters in search. I’d switch positions, that’d be fun. When you have fewer click-throughs and you have a longer tail you get to monetize more. But our search volume is holding fine. We have to convince those buyers to get off the chair and push buy.

Q: Follow up on RPS, you talked about improving relevancy of ads. Can you talk about levers you can pull to improve RPS, how do you view new homepage impact on search

Bartz: Alot of what we are talking about in improving ads is display. You know what an irritating ad is. With RPS, working to drive teh right ad to the right query, better targeting. With how Metro will impact search, we are pleased with search placement on the homepage. improved quality in display, improved relevance in search and make search more prominent will help drive relevancy.

You have to get users to say, I like those. then they tell their friends. You take some of the bad ads off mail, guess what, they stay. All of that is a better experience. All of that will drive advertisers to us.