Saving money is tough work, even when you’re working towards something you really want, like a new car or a vacation. First, there’s the business of actually finding someone to write you a paycheck each month, and then you have to look at that pile of cash sitting in your bank account, just begging to be spent on the latest DVD, book, or gadget that suits your fancy. And there’s always the predictable but expensive costs like rent and insurance that keep eating away at those savings, not to mention the issues you can’t plan for.

Saving money is tough work, even when you’re working towards something you really want, like a new car or a vacation. First, there’s the business of actually finding someone to write you a paycheck each month, and then you have to look at that pile of cash sitting in your bank account, just begging to be spent on the latest DVD, book, or gadget that suits your fancy. And there’s always the predictable but expensive costs like rent and insurance that keep eating away at those savings, not to mention the issues you can’t plan for.

PocketSmith is a new startup that’s looking to help. The site offers a range of tools for managing your financials both now and in the future, hopefully helping you reach your financial goals in the process. This week it’s leaving beta, and is offering the first 50 TechCrunch readers to Email contact@pocketsmith.com a free premium account for six months.

There are a number of well known financial services already on the web, including Wesabe and Mint, which won the to prize at 2007’s TechCrunch 40 conference. But whereas Mint is really about looking at your spending habits and figuring out ways to save, PocketSmith is more of a calendar for finances that lets you set financial goals and track your progress over time.

The other big difference from Mint is that you don’t directly connect your bank accounts to the service. Instead, you can download your transaction history from your bank’s website and upload it, or you can manually enter your transactions. If you’re used these other services and are okay with allowing a startup to access your banking data, this is a bit of an inconvenience, but the upload method really only takes a minute.

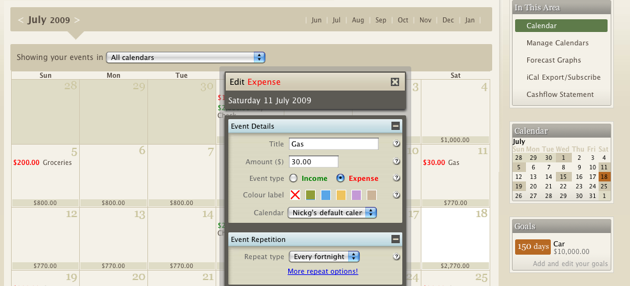

The site iself is very well done, sporting a polished interface and nifty effects that make otherwise mundane tasks a bit more fun. There are also videos for many of the site’s common functions, explaining how you should be using them. And because many of the service’s functions are calendar-based, you can import them into iCal and Outlook, as well as Google Calendar.

Most of the features are broken into one of four sections: Forecast, which lets you create a calendar of your financial activity, updating with regular costs (like rent) and other major expenses that you know are coming up. This section also projects how much money you’ll have months (or a year) down the line. The Accounts section lets you can either manually input or upload your transaction history, while ‘Compares’ lets you visually contrast how your projected financials are matching up with what you actually have. Finally, there’s Goals, where you can list off things that you’re saving for (say, a new car).

It’s the last section that will probably be the most useful for people, as it determines how many days you’ll have to maintain your current savings plan until you can meet a goal. There’s something about being able to watch that countdown tick downwards that can really become a powerful psychological tool, which can help you resist those financial splurges.

PocketSmith offers three different pricing plans: a free option, which allows you to maintain two calendars and track six events; a premium version for around $5 a month that allows for unlimited events and five calendars, and finally a $12 version that allows for unlimited events and ten calendars (Note: the prices on the site are in New Zealand Dollars, so I’ve converted them to US).

All in all the site seems solid, but it’s probably going to appeal to a somewhat different audience than Mint does. This is primarily because using Mint can be a passive experience — you enter your account data once, and it does the rest for you. With PocketSmith, you need to proactively set your goals and make sure that you’re entering any upcoming expenses, which requires a bit more effort. Still, the use case for the sites are pretty different, and there may well be a significant market for PocketSmith.