Last month Time Warner announced that it would likely spin off its AOL assets into a new company, followed by an IPO (10Q SEC filing is here). Little detail was given about the transaction, other than the fact that Google’s 5% stake in AOL would be repurchased. But exactly when the transaction would occur, and what assets it would include, were left unstated. New CEO Tim Armstrong will lead the independent company.

Last month Time Warner announced that it would likely spin off its AOL assets into a new company, followed by an IPO (10Q SEC filing is here). Little detail was given about the transaction, other than the fact that Google’s 5% stake in AOL would be repurchased. But exactly when the transaction would occur, and what assets it would include, were left unstated. New CEO Tim Armstrong will lead the independent company.

Sources close to AOL tell us that the board of directors will make a final decision on the AOL spinoff at a board meeting this Thursday, May 28, possibly undoing the $147 billion 2001 merger of the two companies. Sources characterize the decision as “a done deal.”

The big question is whether AOL’s dial up access business will remain with AOL. Last year Time Warner was in discussions to sell it to Earthlink. The dial up business continues to decay – at one time AOL had 26.7 million dial up subscribers, but it has fallen to just 6.9 million today. Still, it’s a nearly $2 billion business that brings in, sources say, around $1 billion in free cash to AOL. At current decay rates the business will peter out in another couple of years, but for now it’s an important way for AOL to finance growth (more on that in a post later today). Our sources say the dialup business will become part of the new AOL entity.

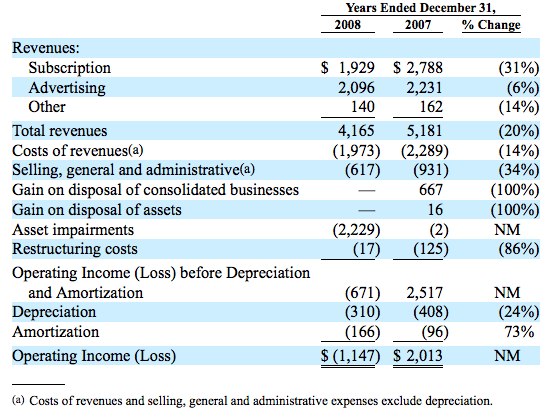

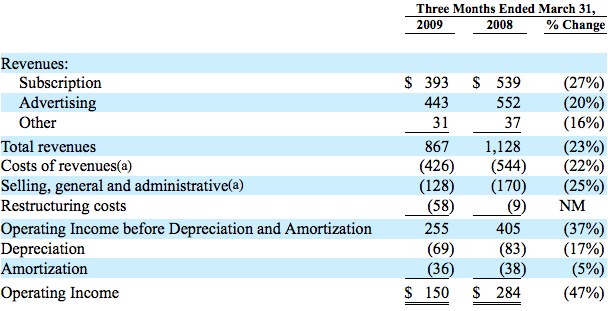

Total AOL revenues in 2008 were $4.2 billion, a 20% drop from 2007. AOL had $867 million in revenue and $150 million in operating income for the first quarter of 2009.

From the 10Q filed last month:

AOL’s business is focused on attracting and engaging Internet consumers and providing advertising services on both the AOL Network and the Third Party Network. In addition to growing its Global Web Services business, AOL is focused on managing costs in this business, as well as managing its declining subscriber base and related cost structure in its Access Services business. In the first quarter of 2009, in an effort to better position its Global Web Services business, AOL undertook a significant restructuring. As a result, for the three months ended March 31, 2009, the Company incurred restructuring charges of $58 million primarily related to involuntary employee terminations and facility closures, and currently expects to incur up to an additional $90 million in restructuring charges during the remainder of 2009.

During 2008, the Company announced that it had begun separating the AOL Access Services and Global Web Services businesses, as a means of enhancing the operational focus and strategic options available for each of these businesses. The Company continues to review its strategic alternatives with respect to AOL. Although the Company’s Board of Directors has not made any decision, the Company currently anticipates that it would initiate a process to spin off one or more parts of the businesses of AOL to Time Warner’s stockholders, in one or a series of transactions. Based on the results of the Company’s review, future market conditions or the availability of more favorable strategic opportunities that may arise before a transaction is completed, the Company may decide to pursue an alternative other than a spin-off with respect to either or both of AOL’s businesses.

The Platform-A business unit sells advertising services worldwide on both the AOL Network and the Third Party Network and licenses ad-serving technology to third-party websites. Platform-A offers to advertisers a range of capabilities and solutions, including optimization and targeting technologies, to deliver more effective advertising and reach specific audiences across the AOL Network and the Third Party Network.

The MediaGlow and People Networks business units develop and operate websites, applications and services that are part of the AOL Network. In addition, AOL’s Products and Technologies group develops and operates components of the AOL Network, such as e-mail, toolbar and search. The AOL Network consists of a variety of websites, related applications and services that can be accessed generally via the Internet or via AOL’s Access Services business. Specifically, the AOL Network includes owned and operated websites, applications and services such as AOL.com, e-mail, MapQuest, Moviefone, Engadget, Asylum, international versions of the AOL portal and social media properties such as AIM, ICQ and Bebo. The AOL Network also includes TMZ.com, a joint venture with Telepictures Productions, Inc. (a subsidiary of Warner Bros. Entertainment Inc.), as well as other co-branded websites owned by third parties for which certain criteria have been met, including that the Internet traffic has been assigned to AOL.

During the first quarter of 2009, AOL’s Advertising revenues were negatively affected by weakening global economic conditions, which contributed to lower demand from a number of advertiser categories, a deterioration in the financial position of certain significant customers and downward pricing pressure on advertising inventory, as well as an overall increase in marketplace competition, an increased volume of inventory monetized through lower-priced sales channels and other sales execution issues. During the remainder of 2009, the Company anticipates that these factors and trends may continue to negatively affect AOL’s Advertising revenues. Additionally, in the first quarter of 2009, AOL made a number of organizational and personnel changes, including hiring a new chief executive officer and changing the leadership within its Platform-A business unit.

The AOL Network and Third Party Network components of the Global Web Services business have differing cost structures. Third Party Network advertising has historically had higher traffic acquisition costs (“TAC”) and, therefore, lower incremental margins than display advertising. As a result, a period-over-period increase or decrease in aggregate Advertising revenues will not necessarily translate into a similar increase or decrease in Operating Income before Depreciation and Amortization attributable to AOL’s advertising activities.

Paid-search advertising activities on the AOL Network are conducted primarily through AOL’s strategic relationship with Google Inc. (“Google”). In connection with the expansion of this strategic relationship in April 2006, Google acquired a 5% interest in AOL, and, as a result, 95% of the equity interests in AOL are indirectly held by the Company and 5% are indirectly held by Google. As part of the April 2006 transaction, Google received certain registration rights relating to its equity interest in AOL. In late January 2009, Google exercised its right to request that AOL register Google’s 5% equity interest for sale in an initial public offering. Time Warner has the right, but not the obligation, to purchase Google’s equity interest for cash or shares of Time Warner common stock based on the appraised fair market value of the equity interest in lieu of conducting an initial public offering. The Company is in discussions with Google and has notified Google of its intention to purchase the 5% equity interest.

AOL’s Access Services business offers an online subscription service to consumers that includes dial-up Internet access. AOL continued to experience declines during the first quarter of 2009 in the number of its U.S. subscribers and related revenues, due primarily to AOL’s decisions to focus on its advertising business and offer most of its services (other than Internet access) for free to support the advertising business, AOL’s significant reduction of subscriber acquisition and retention efforts, and the industry-wide decline of the dial-up ISP business and growth in the broadband Internet access business. U.S. subscribers declined 0.6 million in each of the three-month periods ended March 31, 2009 and 2008. The decline in subscribers has had an adverse impact on AOL’s Subscription revenues, and the Company expects the total number of subscribers to continue to decline. AOL’s Advertising revenues associated with the AOL Network, in large part, are generated from the activity of current and former AOL subscribers. Therefore, the decline in subscribers also could have an adverse impact on AOL’s Advertising revenues generated on the AOL Network to the extent that subscribers canceling their subscriptions do not maintain their relationship with and usage of the AOL Network.

Update: Confirmed:

Time Warner Inc. Announces Plan to Separate AOL

May 28, 2009

NEW YORK – Time Warner Inc. (NYSE:TWX) today announced that its Board of Directors has authorized management to proceed with plans for the complete legal and structural separation of AOL from Time Warner. Following the proposed transaction, AOL would be an independent, publicly traded company.

Time Warner Chairman and Chief Executive Officer Jeff Bewkes said: “We believe that a separation will be the best outcome for both Time Warner and AOL. The separation will be another critical step in the reshaping of Time Warner that we started at the beginning of last year, enabling us to focus to an even greater degree on our core content businesses. The separation will also provide both companies with greater operational and strategic flexibility. We believe AOL will then have a better opportunity to achieve its full potential as a leading independent Internet company.”

After the proposed separation is complete, AOL will compete as a standalone company – focused on growing its Web brands and services, which currently reach more than 107 million domestic unique visitors a month, as well as its advertising business, which operates the leading online display network that reaches more than 91% of the domestic online audience. AOL will also continue to operate one of the largest Internet access subscription services in the U.S.

AOL Chairman and Chief Executive Officer Tim Armstrong said: “This will be a great opportunity for AOL, our employees and our partners. Becoming a standalone public company positions AOL to strengthen its core businesses, deliver new and innovative products and services, and enhance our strategic options. We play in a very competitive landscape and will be using our new status to retain and attract top talent. Although we have a tremendous amount of work to do, we have a global brand, a committed team of people, and a passion for the future of the Web.”

Today, Time Warner owns 95% of AOL, and Google holds the remaining 5%. As part of a prior arrangement, Time Warner expects to purchase Google’s 5% stake in AOL in the third quarter of 2009. After repurchasing this stake, Time Warner will own 100% of AOL. Accordingly, once the proposed separation is completed, Time Warner shareholders will own all of the outstanding interests in AOL.

The proposed transaction will be structured as tax-free to Time Warner stockholders. The transaction is contingent on the satisfaction of a number of conditions, including completion of the review process by the Securities and Exchange Commission of required filings under applicable securities regulations and the final approval of transaction terms by Time Warner’s Board of Directors. Time Warner aims to complete the proposed transaction around the end of the year.