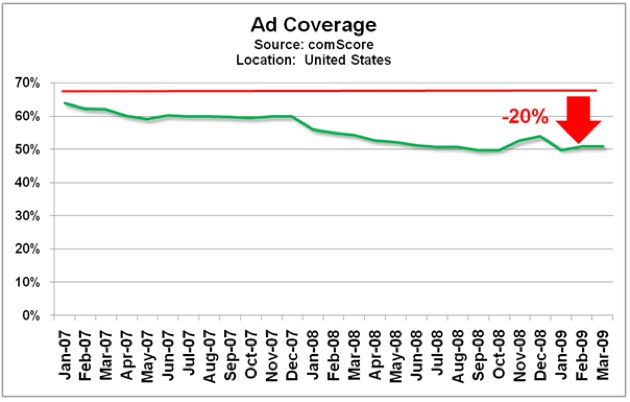

Comscore has a fascinating post today talking about the relative decline in paid search ad clicks when compared to search query volume in the U.S. Search queries are up 68% in the last year, but paid clicks are up only 18% in the same period.

Comscore says the reason for the decline is that there are less search queries that show ads, and proposes that a reason for less ads is that searches are getting longer, up from an average of 2.8 words per query a year ago to just over 3 today. Comscore says: “And this apparently reduces the likelihood that an advertiser has bid to have his/her ad included in the results page from these longer queries, due to paid search advertising strategies that limit ad coverage, such as Exact Match, Negative Match, and bid management software campaign optimization.”

Yeah I’m not buying that.

The reason there are less ads on search results, I believe, is that there are, simply, less advertisers. Far less. Big spenders, the category leaders, are just gone. Sharper Image, Wickes Furniture, Levitz, Foot Locker, Wilson’s Leather, Ann Taylor, Zales, Mervyn’s, Macy’s, Circuit City and a ton of other retailers are either shutting down entirely or closing lots of stores. And more are on the way. All of these companies used to spend tons of money on paid search ads. Those budgets don’t exist any more.

Efficient Frontier says of Q1 2009:

“Search engine spending was down overall by 13% YOY and 3.3% Q/Q. The relationship between spending and ROI trends shows that advertisers continue to adjust their budgets to compensate for the economic downturn and to improve ROI. Monthly spend trends indicate that the additional decline in search engine spending in Q1 2009 was directly linked to the decline in ROI between November 2008 and January 2009. As ROI continued to decline, advertisers continued to cut their budgets in an effort to become more efficient.”

and

“CPCs are down across the board by 19% YOY and 13% Q/Q indicating that the entire marketplace is deflating as advertisers cut budgets and spend less. On a Q/Q basis, CPCs have declined by 14% on Google Search, 7% on Google Content, 28% on Microsoft Live Search, and 16% on Yahoo Search in Q1 2009 over Q4 2008.”

I agree with Comscore that the main driver for the decline in ad coverage are improvements in ad targeting, particularly by Google. But the secondary driver, it seems to me, has nothing to do with query length. Perhaps it’s simply because so many advertisers are no longer advertisers. Drawing a line from that to less ad impressions is fairly straightforward.