When it comes to the amount of money being made on social networks, it seems like nobody really knows what’s going on. Sure, we occasionally hear about huge paydays for companies like Zynga, but very few people are willing to talk, and even when they do their figures are nearly impossible to verify independently.

When it comes to the amount of money being made on social networks, it seems like nobody really knows what’s going on. Sure, we occasionally hear about huge paydays for companies like Zynga, but very few people are willing to talk, and even when they do their figures are nearly impossible to verify independently.

Gambit, a payment engine that powers the microtransactions for a number of popular social network apps, is looking to help shed some light on the matter. Since launching to the public last January, the company has grown to seeing over 20 million uniques a month and has racked up a number of notable clients, including SmallWorlds, Facebook’s Friends For Sale, and Playdom, which is currently one of MySpace’s leading application developers.

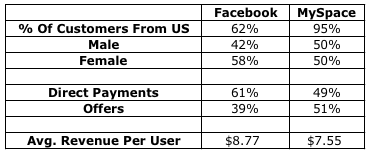

We asked the company (which also blogs about the industry) to pull together some data that was representative of the trends it was seeing across Facebook and MySpace, and the results are quite interesting, if not terribly surprising. The data comes from two applications that Gambit considers to be “very comparable” games, one from each social network. But it comes with two caveats: it only includes information about users who are actually driving revenue either through direct payments or offers (in other words, it neglects to take into account any advertising revenue) and the figures come from only one data point. That said, Gambit says that the stats below are representative of the trends it is seeing across its entire platform.

The first stat, which measures the amount of payments to come from the US vs international audiences, isn’t surprising at all. Facebook is seeing huge growth internationally (where MySpace continues to struggle), so far more of Facebook’s transactions come from abroad than they do on MySpace.

The data also indicates that Facebook users are more likely to engage in direct payments (submitting money via credit card or services like PayPal) than they are through lead-generation offers (which invite users to try out a new service), while MySpace sees about an even split.

Perhaps the most interesting point is the average revenue per user being earned by applications on Facebook and MySpace. I’ve previously heard that MySpace users were more valuable than Facebook users, but Gambit’s data contradicts this, at least for users who are engaging in microtransactions and offers (it’s possible that MySpace apps can drive more revenue through advertising, which isn’t measured in this data). Still, as micro-transactions become more popular this is definitely something developers are going to keep in mind – if you can convince a user to get out their wallets, they’re likely to pay more money on Facebook than they are on MySpace.