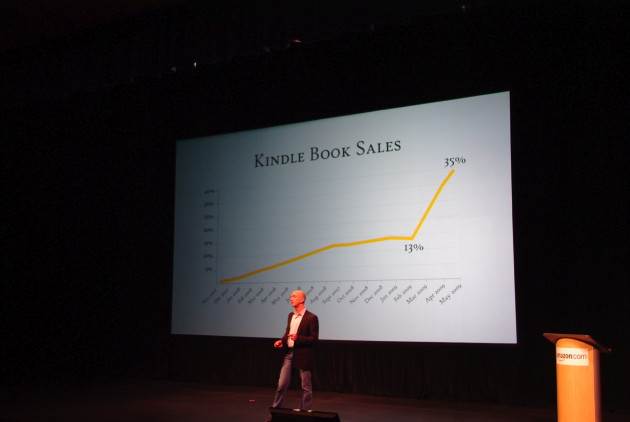

The most startling thing Jeff Bezos said today at Amazon’s launch of the Kindle DX, it’s large-format Kindle optimized for textbooks and newspapers, was this statistic: For books that are available on the Kindle, sales are already 35 percent of the same books in print, up from 13 percent just a few months ago. In other words, if a paper book sells 10,000 copies on Amazon, it will sell an additional 3,500 digital copies on the Kindle. Let me repeat that, digital books via the Kindle are selling at 35 percent the level of physical books 18 months after launch.

That is an amazing ramp up. The Kindle now has 275,000 titles, most of them are the “head” titles that most likely make up the bulk of Amazon’s total book sales. So how much of Amazon’s book sales are now digital? I tried to ask a few Amazon execs here at the press conference, but they won’t say. It is no doubt a huge number. Amazon sells $2.7 billion worth of “media” every quarter, which includes books, music, and movies. Books is still one of its largest categories, if not the largest. Let’s say Amazon sells $1 billion worth of books every quarter. And its top 275,000 titles represent 80 percent of sales. Kindle book sales alone would amount to $280 million ($1.1 billion a year), and that would not include the cost of the device. See correction below.

I am making these numbers up, but even if you change it to 50 percent, Kindle book sales would be trending at $175 million a quarter ($700 million a year). The Kindle might turn out to be Amazon’s biggest growth business yet.

Correction: After I posted this, I tried to verify the numbers once again. The 35 percent refers to the number of titles or units sold, not revenues, and is indeed additive. So let’s take the example above again. If 10,000 copies of a book are sold in physical form, and another 3,500 in digital form that is a total of 13,500 copies sold. The Kindle portion selling at 35 percent the rate of physical titles, but represents 26 percent of the total. (Showing it as a percentage of print books rather than as a percentage of the total sales makes for a better slide).

So let’s take this new number, 26 percent, and apply it to my assumptions above. At 80 percent of sales, instead of $280 million a quarter, it would be $208 million (26% of $800M). At 50 percent, it would be $130 million (26% of $500M).

But there is one more step. You also have to take into account the fact that Kindle books are cheaper than paper books, at least for new titles. A new title on the Kindle sells for $9.99, compared to $24.99 for a hardcover book. You have to factor in paperback books also, which tend to cost about $10 for more recent titles. So there is some discount. For the sake of argument, let’s say it averages to about a 50 percent discount. That would cut the revenue numbers down in half again to $104 million and $65 million, respectively. On an annualized basis, that comes to somewhere between $520 million and $260 million in Kindle book revenues (again, this does not include device revenues).

The numbers change based on what assumptions you plug in, but as a point of comparison, Citi analyst Mark Mahaney is estimating Kindle book sales of only $189 million this year, going to $612 million in 2010 (with total Kindle-related sales of $1.2 billion in 2010, if you add in device sales). At the very least, it looks like Amazon is well on track to meet Mahaney’s estimates, and may be ahead of them already.