Microsoft just announced earnings for its third fiscal quarter. Revenues were down 6 percent to $13.65 billion, and net income was down a whopping 32 percent to $2.98 billion or $0.33 EPS. Analysts consensus was closer to $14 billion for revenues and $0.39 for non-GAAP EPS, which Microsoft met thanks to its cost-cutting measures. Still, this can’t be feeling good for Microsoft.

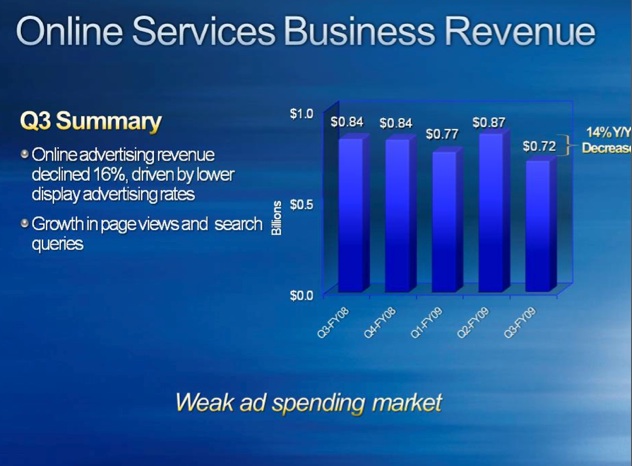

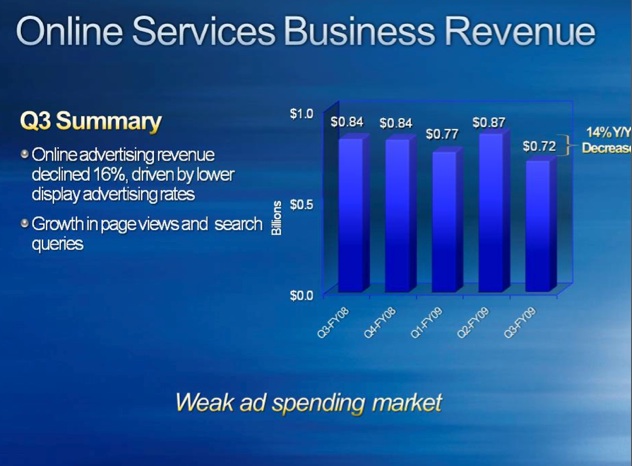

The company is exposed to the weaknesses in the economy in general, and soft demand for PCs and servers in particular. Revenues in its Client business (Windows) was down 15.6 percent to $3.40 billion. It’s servers and tools business proved the the healthiest with a 7 percent increase in revenues to $3.47 billion, marking the first time I believe that servers and tools brought in more revenues than the client business. The online business saw revenues decline 14.5 percent to $721 million, and its loss doubled to $575 million.

The online business suffered from a 16 percent decline in advertising revenues, driven by lower display ad rates. On teh bright side, page views and search queries on Microsoft sites were both up.

1.7 million Xbox360 consoles were sold in the quarter, up 30 percent, but revenues for the Entertainment and Devices business remained flat at $1.57 billion. And it actually dipped into an operating loss of $31 million.

Net cash from operations was $6 billion in the quarter, $1 billion less than a year ago, but Microsoft still ended the quarter with $25.3 billion in cash on its balance sheet.

Here is the breakdown in revenues and operating profits by business:

MICROSOFT CORPORATION

Segment Revenue and Operating Income (Loss)

(In millions) (Unaudited)

|

Three Months Ended

March 31, |

Nine Months Ended

March 31, |

| |

2009 |

2008 |

|

2009 |

2008 |

|

|

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Client |

$3,404 |

$4,033 |

|

$11,604 |

$12,506 |

|

| Server and Tools |

3,467 |

3,238 |

|

10,616 |

9,381 |

|

| Online Services Business |

721 |

843 |

|

2,357 |

2,377 |

|

| Microsoft Business Division |

4,505 |

4,731 |

|

14,330 |

13,663 |

|

| Entertainment and Devices Division |

1,567 |

1,592 |

|

6,564 |

6,616 |

|

| Unallocated and other |

(16) |

17 |

|

(133) |

40 |

|

|

|

|

|

|

|

|

| Consolidated |

$13,648 |

$14,454 |

|

$45,338 |

$44,583 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Operating Income (Loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Client |

$2,514 |

$3,115 |

|

$8,689 |

$9,855 |

|

| Server and Tools |

1,344 |

1,080 |

|

3,978 |

3,170 |

|

| Online Services Business |

(575) |

(226) |

|

(1,521) |

(737) |

|

| Microsoft Business Division |

2,877 |

3,127 |

|

9,325 |

9,010 |

|

| Entertainment and Devices Division |

(31) |

106 |

|

299 |

668 |

|

| Corporate-level activity |

(1,691) |

(2,912) |

|

(4,394) |

(5,374) |

|

|

|

|

|

|

|

|

| Consolidated |

$4,438 |

$4,290 |

|

$16,376 |

$16,592 |

|

|

|

|

|

|

|

|

And here is the main income statement and balance sheet:

MICROSOFT CORPORATION

INCOME STATEMENTS

(In millions, except per share amounts) (Unaudited)

|

Three Months Ended

March 31, |

Nine Months Ended

March 31, |

| |

2009 |

2008 |

|

2009 |

2008 |

|

|

| Revenue |

$13,648 |

$14,454 |

|

$45,338 |

$44,583 |

|

| Operating Expenses: |

|

|

|

|

|

|

|

|

2,814 |

2,514 |

|

9,569 |

8,732 |

|

|

|

2,212 |

2,035 |

|

6,785 |

5,757 |

|

|

|

2,981 |

3,274 |

|

9,687 |

9,377 |

|

|

General and administrative |

|

913 |

2,341 |

|

2,631 |

4,125 |

|

|

|

290 |

– |

|

290 |

– |

|

|

|

|

|

|

|

|

|

|

9,210 |

10,164 |

|

28,962 |

27,991 |

|

|

|

|

|

|

|

|

| Operating income |

4,438 |

4,290 |

|

16,376 |

16,592 |

|

| Other income (expense) |

(388) |

520 |

|

(697) |

1,254 |

|

|

|

|

|

|

|

|

| Income before income taxes |

4,050 |

4,810 |

|

15,679 |

17,846 |

|

| Provision for income taxes |

1,073 |

422 |

|

4,155 |

4,462 |

|

|

|

|

|

|

|

|

| Net income |

$2,977 |

$4,388 |

|

$11,524 |

$13,384 |

|

|

|

|

|

|

|

|

| Earnings per share: |

|

|

|

|

|

|

|

|

$0.33 |

$0.47 |

|

$1.29 |

$1.43 |

|

|

|

|

|

|

|

|

|

|

$0.33 |

$0.47 |

|

$1.28 |

$1.41 |

|

|

|

|

|

|

|

|

| Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

8,891 |

9,307 |

|

8,960 |

9,349 |

|

|

|

|

|

|

|

|

|

|

8,904 |

9,428 |

|

9,008 |

9,492 |

|

|

|

|

|

|

|

|

| Cash dividends declared per common share |

$0.13 |

$0.11 |

|

$0.39 |

$0.33 |

|

|

|

|

|

|

|

|

MICROSOFT CORPORATION

BALANCE SHEETS

(In millions)

|

|

|

| |

|

|

|

March 31, 2009 |

June 30, 2008 (1) |

|

|

| |

|

|

|

(Unaudited) |

|

|

| Assets |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

|

|

$7,285 |

$10,339 |

|

|

Short-term investments (including securities pledged as collateral of $1,445 and $2,491) |

|

|

|

|

18,055 |

13,323 |

|

|

|

|

|

|

|

|

|

Total cash, cash equivalents, and short-term investments |

|

|

|

|

25,340 |

23,662 |

|

| Accounts receivable, net of allowance for doubtful accounts of $242 and $153 |

|

|

|

9,182 |

13,589 |

|

| Inventories |

|

|

|

657 |

985 |

|

| Deferred income taxes |

|

|

|

1,926 |

2,017 |

|

| Other |

|

|

|

3,619 |

2,989 |

|

|

|

|

|

|

|

|

|

|

|

|

|

40,724 |

43,242 |

|

| Property and equipment, net of accumulated depreciation of $7,236 and $6,302 |

|

|

|

7,112 |

6,242 |

|

| Equity and other investments |

|

|

|

4,112 |

6,588 |

|

| Goodwill |

|

|

|

12,554 |

12,108 |

|

| Intangible assets, net |

|

|

|

1,756 |

1,973 |

|

| Deferred income taxes |

|

|

|

956 |

949 |

|

| Other long-term assets |

|

|

|

1,639 |

1,691 |

|

|

|

|

|

|

|

|

|

|

|

|

|

$68,853 |

$72,793 |

|

|

|

|

|

|

|

|

| Liabilities and stockholders’ equity |

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

|

|

$3,017 |

$4,034 |

|

|

|

|

|

|

1,999 |

– |

|

|

|

|

|

|

2,644 |

2,934 |

|

|

|

|

|

|

773 |

3,248 |

|

|

Short-term unearned revenue |

|

|

|

|

10,924 |

13,397 |

|

|

Securities lending payable |

|

|

|

|

1,533 |

2,614 |

|

|

|

|

|

|

2,933 |

3,659 |

|

|

|

|

|

|

|

|

|

Total current liabilities |

|

|

|

|

23,823 |

29,886 |

|

| Long-term unearned revenue |

|

|

|

1,388 |

1,900 |

|

| Other long-term liabilities |

|

|

|

6,699 |

4,721 |

|

| Commitments and contingencies |

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

| Common stock and paid-in capital – shares authorized 24,000; outstanding 8,898 and 9,151 |

|

|

|

61,896 |

62,849 |

|

| Retained deficit, including accumulated other comprehensive income of $726 and $1,140 |

|

|

|

(24,953) |

(26,563) |

|

|

|

|

|

|

|

|

|

Total stockholders’ equity |

|

|

|

|

36,943 |

36,286 |

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity |

|

|

|

|

$68,853 |

$72,793 |

|

|

|

|

|

|

|

|

(1) Derived from audited financial statements.

![]()

![]()