There’s a huge difference between what venture capitalists say and what they do. For much of the last decade some of the same partners that keep saying Silicon Valley will never decline as the startup epicenter of the world are spending every month flying to China. And of course in the post-2000 years every partner said, “Oh we never really got into that whole dot com thing…” Huh. Wonder who did all those deals?

Another classic is this one: “Recessions are the best times to start companies! We always invest in downturns! There are fewer competitors, and you get a better caliber of entrepreneur! Dollars can stretch further because salaries and rents are lower! We’re not looking to take a company public for years, so why would we run our companies based on the public markets and macro economy?”

Bullshit. It fell off a cliff in 2001 and 2002 and it’s falling off a cliff now. (More on that in a second.) But there’s a difference: Funding levels, returns and the percentage of that money going to new ventures never got nearly as high as they did in the 1999-2000 years. So when we talk about steep drops, we’re talking about less of a bubble bursting and more of an industry correcting for more than a decade of scale and liquidity issues.

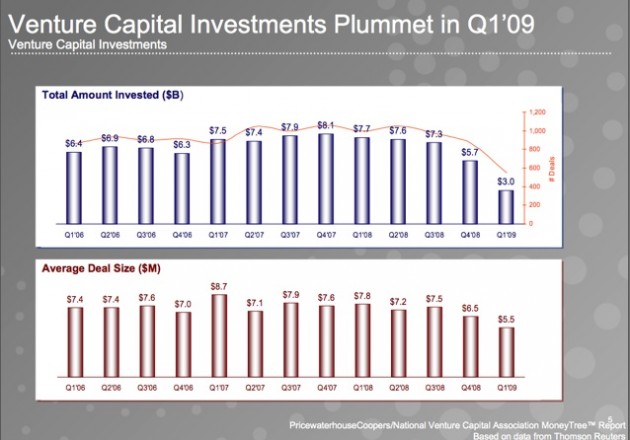

And make no mistake—it’s a steep drop. Venture funding fell by 50% nationally from the first quarter in 2008 to the first quarter of 2009, totaling to $3.9 billion, according to Dow Jones Venture Source. That’s the lowest total since 1998. PricewaterhouseCoopers and the National Venture Capital Association had it falling farther to $3 billion.

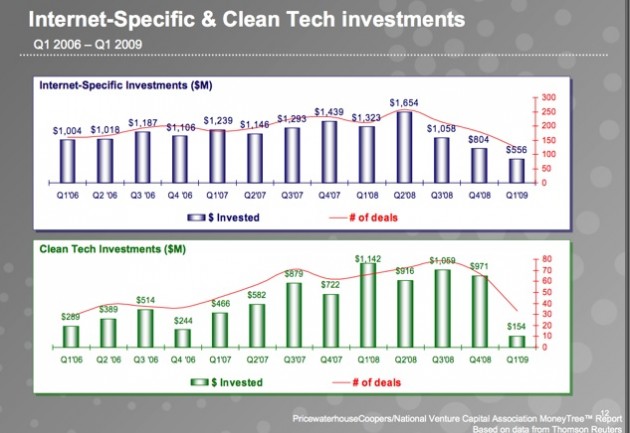

Information technology investments fell 53% year-over-year to $1.7 billion—the lowest since 1997, and the lowest volume of deals since 1995. And clean tech? Well so much for that being the future of the U.S. economy: It fell by 74% to a paltry $117 million. (These numbers according to Dow Jones, see the numbers from PWC/ NVCA in the chart below.)

The results are so different than what we saw in the last downturn that I could spend eight posts writing about them. But I’ll distill my take-aways to three points for now.

1. Don’t be fooled: This is not just about the recession. Investments in startups declined in the last downturn, but investments in VC firms didn’t fall nearly as much. Mostly it was the firms themselves deciding to raise smaller funds. That means venture capital as an industry never had a shake-out from the go-go 1999-2000 era. It’s no secret and every VC will admit it: There are a lot of clowns still throwing around a lot of venture money that have no business doing it. (Of course, it’s a well-known industry joke that no one thinks he or she is the clown.)

Returns, on the other hand, did go down. And they never really got back up, given the amount invested. But the industry is graded on a ten-year time horizon so that didn’t matter much. Once returns from 1999 and 2000 fall off that scale, it will. Returns will look at or below the S&P 500 for what is supposed to be a niche, high-risk/high-reward asset class. It takes forever to correct because fund cylces are so long, and the asset class is so illiquid. But it won’t go uncorrected, and the witching hour is getting close.

What does this have to do with money going out to startups? VCs are scared for the first time in a long time. There’s no obvious high growth sector of the tech economy, and their investors are hit in nearly every nook and cranny of their portfolios. They’re not sure how to do their jobs anymore when nothing can go public and acquisitions are few and far between.

This is why the amount has fallen so precipitously, especially in Silicon Valley. In past cycles, VCs have pulled closer to home, and the percentage of money going to Valley startups has increased even as the volume of total deals has gone down. Not this time. According to Dow Jones, Bay Area deals fell by 57%– a faster rate than the rest of the country. In clean tech just one deal was done in the Valley.

Now, this could point to a savvier Valley entrepreneur who saw the downturn coming. After all, most of the well-known Web 2.0 names like Ning, Slide, Facebook and LinkedIn raised huge rounds just before the economic crisis hit, just in case. That could have artificially boosted the 2008 numbers and artificially lowered the 2009 numbers. We’ll have to see how the next two quarters shake out. I expect higher volume of deals in the next few quarters, but also a surge in recapitalizations.

More concerning is the free-fall in the percentage going to new deals. During the last downturn it fell to 24%– down from more than 50% during the go-go days and 33% historically. They never got much above that. In the first quarter only 18% of deals went to new companies, according to Dow Jones.

2. Revenge of the steady-eddy. What didn’t fall, comparatively? Health care and investments in New England. Both have become the reliable base hits of the venture business. When it comes to healthcare, the vast majority of exits are licensing deals with big pharma or IP acquisitions of device companies. There’s almost zero expectation of anyone going public–even in better days– because Sarbanes Oxley has cut off the ability for small market-cap companies to go out. The next Genentech? Don’t hold your breath.

Similarly, most Boston VCs never really got the consumer Web. Much of their expertise has remained in areas like telecom and healthcare, and many of their investors have morphed into more financial engineers than company builders. This meant that New England fell from the no. 2 region for venture investment for the first time in 2008, as Southern California and New York ascended. It’s now solidly back at no. 2 and investments fell a comparatively tiny 16% in the first quarter, according to Dow Jones.

3. Bye-bye Clean Tech Hyperbole. It’s not that clean tech isn’t a huge opportunity. It’s not that it isn’t an important opportunity. But I’ve never believed it was the next wave equivalent to the personal computer, as several VCs and even President Barack Obama said during the campaign. For one thing, there’s a lot of science that needs to be developed, huge amounts of money that need to be injected, and more government cooperation and subsidies than the US currently has. It’s just not the type of investing that most VCs addicted to the crack of quick-to-market, hyper-growth Internet companies can adjust to. Maybe in another ten years, but it’s not the venture guys’ salvation anytime soon.

Hang in there, startups. Take a hike, clowns.

http://widget.icharts.net/icharts.swf