While advertising revenues have been disappointingly low for most applications on Facebook and other social networks, another option app developers are increasingly turning towards is micropayments for virtual goods or premium features. Both Facebook and MySpace have admitted that they are working on their own payment systems, and Apple could play a role as well since it already has a payment system in place for iPhone apps (although even Apple is running into some bumps).

While the bigger players are fiddling with their payment system plans, nimbler startups are moving in to fill the gap. One of these is Spare Change Payments, which is trying to become the Paypal of micropayments. A year after launch, more than 700 apps across Facebook, MySpace, and Bebo use Spare Change for micropayments. Spare Change is processing $2.5 million a month in micropayments, which is a $30 million annual run-rate. The apps that are having the most success with micropayments are games and ones that sell virtual goods.

Over a million people have already signed up for Spare Change. Hundreds of thousands of those use it actively on a monthly basis. And it is not all nickels and dimes. Last year, 250 people spent more than $1,000 apiece on digital goods through Spare Change.

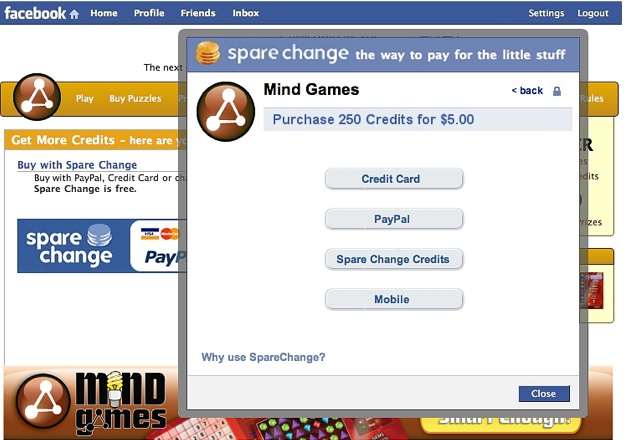

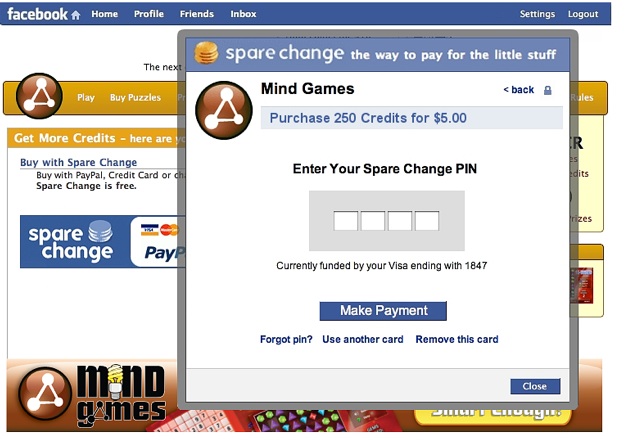

Now, the company is making it easier for consumers to pay through Spare Change with a new payment widget that pops up in each app instead of sending people off to a separate payments page. You can choose between several payment methods including a credit card, Paypal, Spare Change credits, or through your mobile phone bill. Once you buy a minimum of $2 worth of Spare Change credits, you can use them as currency for apps that charge as little as $0.10 at a time. It is also introducing a PIN ID for users who choose to tie their accounts to a credit card so that they can use the same PIN across any app that uses Spare Change. The experience is designed to be familiar to anyone who has ever downloaded an app from the iTunes store. You enter your PIN, and then go back to the app. The company accepts payments from 190 different countries.

The first app to launch with the new widget is Mind Games on Facebook. It requires developers to add only three lines of code. Spare Change will roll it out to MySpace and Bebo soon. Spare Change is designed specifically for social networks. Customer support is done via the direct messaging systems inside each network, and the company analyzes the social graph to sniff out fraud. For instance, it looks at how many friends someone has and other factors to assign risk scores to individual consumers. Spare Change has been bootsrapped with only about $500,000 in seed funding, and two of the co-founders (Mark Rose and Simon Ru) previously worked at Paypal.

For micropyaments, Spare Change is much cheaper than Paypal, which offers its own micropayment option. Paypal charges 5 percent plus $0.05 for transactions less than $12, but only for premium accounts that qualify (otherwise, for most small accounts, it is the normal rate of 2.9 percent plus $0.30) . In contrast, Spare Change takes a processing fee of 8 percent for each transaction. CEO Lex Bayer points out that while Paypal has a micropayments offering, it does not seem to be a huge priority. “PayPal is not well designed for micropayments or digital goods,” he says. The logic driving Paypal is to encourage larger transactions because that is where Paypal makes more money.

A bigger concern for him should be if Facebook, MySpace, or Apple ever decide to jump into the micropayments game. Meanwhile, he has an opportunity to stake out a piece of the micropayments market and fight it out with the other startups eying the same prize. For instance, Zuora recently launched subscription billing for Facebook apps, Zong and Mobilecash are trying to tap into mobile payments (although the fees are still too high). Whoever figures it out first will be collecting more than just nickels and dimes.