Home-Account, a recently launched mortgage search and counseling service, has secured $1 million in seed and angel funding. The largest investor is Charles River Ventures, which gave the startup $300,000 through its QuickStart Seed Funding Program (the program usually only gives startups $250,000 but saw promise in Home-Account). Additional investors include many well-known Silicon Valley entrepreneurs and investors: Marc Benioff, Ron Conway, Mark Pincus, Jeff Clavier, Arjun Gupta, and Gigi Brisson.

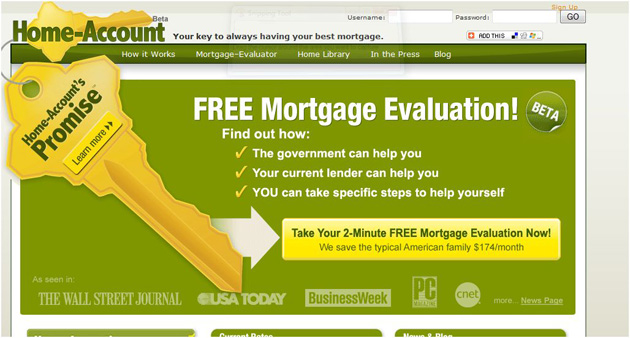

Home-Account offers a compelling service for those who are looking for mortgage or to re-finance. In the current economy where credit is difficult to access, Home-Account helps consumers find the right mortgage for their needs and credit histories. Here’s how it works. Consumers fill out a free online mortgage profile to determine if their credit history qualifies them for a mortgage and what interest rates they could qualify for. Once Home-Account determines that a consumer qualifies for a mortgage, the startup will get mortgage offers from its partner lenders (this service costs users $10 per month).

With credit standards tightening for mortgages, many consumers may not qualify for a mortgage in the current climate. Home-Account offers a second service (also $10 per month) which will help consumers with poor credit history improve their credit scores and get their financial history in order to become more desirable applicants for mortgage lenders.

CEO Mark Goldstein says that he wants Home-Account to be the Kayak.com of mortgages. He says that Home-Account creates a better, more transparent way to get a mortgage. A good mortgage broker should do a lot of hand holding, says Goldstein, and recently, mortgage brokers haven’t been doing their jobs correctly. Home-Account doesn’t make commissions from the buyers or the lenders, like some online mortgage services like LendingTree.com and LowerMyBills.com. It makes money solely from the consumer subscriptions.

Goldstein formerly co-founded BlueLight.com, which was Kmart’s foray into e-commerce during the first dotcom bubble. The Home-Account team is partly made up of mortgage technology experts from Washington Mutual. Since the startup’s launch, 25,000 consumers have used the mortgage evaluator and several hundred have signed up for the paid mortgage finder service. For a subscription service, however, there is sure to be a lot of turnover. Once a consumer finds a mortgage, they won’t need the service anymore. Only people with the worst credit will have any incentive to keep their subscriptions going, and Home-Account will have the perverse economic incentive of keeping their hope alive as long as possible.