Angel and VC funding platform Angelsoft has launched an investor filtering tool, allowing entrepreneurs the ability to access detailed profiles on over 1,000 venture capital firms and angel investment groups in the U.S. Angelsoft allows startups to “push” their business ideas to over 400 angel investment groups and 15,949 investors across the world. The site formerly focused on connecting entrepreneurs to angel and early-stage investors only, but recently changed its model to include VC firms.

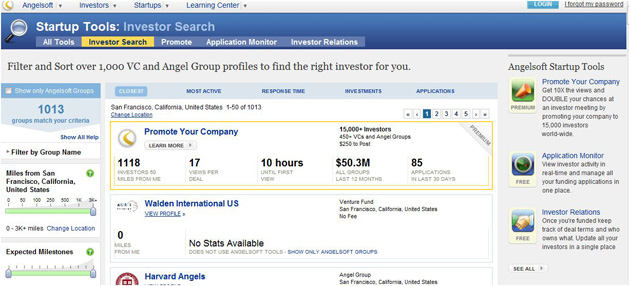

Angelsoft calls it an investor search engine, but it lacks a search box (a big flaw). Instead, entrepreneurs use Kayak-like filters to adjust their sorting results by how much an investment firm usually invests, what terms they typically offer, as well as by company-based criteria such as industry, location and stage. VC and angel firm profiles include a snapshot of the fund, industry expertise, prior investments, executive profiles and links to the LinkedIn profiles of investors. For the 450 investment groups that use Angelsoft’s VC and Angel dealflow management tools, the search engine results provide even more data, including a firm’s average response time to entrepreneurs applying for funding, number of applications a firm receives each month and additional past funding history.

The new investor sorting tool gives startups the power to vet and gain insight into potential investment firms and then choose to apply for funding from the firm which best fits their needs. It is certainly an interesting way to add more transparency into the funding world. Angelsoft was launched in 2004 by David S. Rose, Chairman of the New York Angels, and Ryan Janssen. The company’s platform is currently used by 450 angel groups and VCs (that use the platform for deal workflow), with 2,500 startup applications coming in a month. In December, the number of startup applications per month increased to just over 3,000, perhaps a sign that the economy is taking its toll on the ability of startups to get funding through more traditional means. According to Angelsoft, 2.6 percent of the applicants ultimately get funded, which seems relatively small, but that number has increased since December. As more traffic is driven to the site, the number of completed deals could rise.