With Time Warner reporting earnings yesterday, we now have online advertising numbers for the fourth quarter from the four largest players: Google, Yahoo, Microsoft, and AOL. Tallying up their online advertising revenues provides a decent proxy for the health of the overall online advertising industry as a whole, since they represent a majority of those revenues. (For comparison, see IAB numbers for the U.S. only). After a full year of slowing growth, their combined ad revenues actually picked up in the fourth quarter, showing a 3 percent rise compared to the third quarter. Combined revenues grew 8 percent on an annual basis.

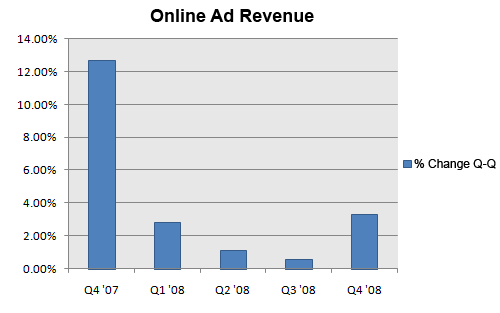

Like everyone else, I’ve been expecting to see continuing pressure on Internet advertising. In the third quarter, the sequential growth of the combined ad revenues from these four companies ground to a halt, going from 12.7 percent sequential growth in the fourth quarter of 2007 to 0.6 percent in the third. (All growth rates are quarter over quarter, unless otherwise noted).

What the slight rebound in growth tells us is that search advertising may be making up for the continued weakness in display advertising, which each of these companies acknowledged in their conference calls. The question is whether sequential growth will remain in this low range for the rest of the year, or whether search advertising can push it higher. One quarter’s worth of data is not enough to make any conclusons on that front, but at least these numbers provide a ray of hope.

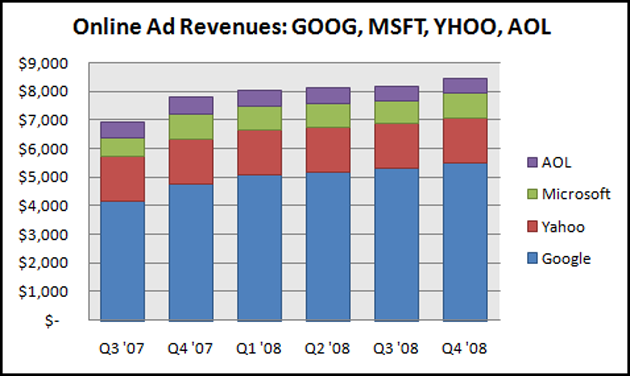

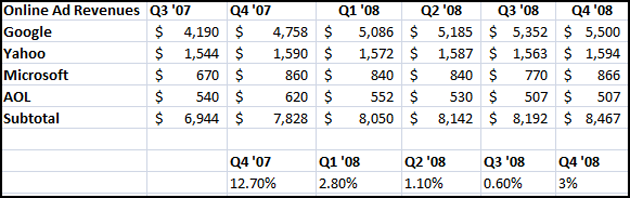

The combined ad revenues totaled $8.5 billion in the fourth quarter, up from $8.2 billion in the third quarter and $7.8 billion in the fourth quarter of 2007. Google continued to dominate, accounting for 65 percent of those revenues, up from 61 percent from a year ago but slightly down from its 65.3 percent share in the third quarter. Google contributed slightly more than half of the growth. Yahoo’s 19.1 percent share of revenues went up quarter-over-quarter by the same amount that Google’s went down (0.3 percent). Microsoft’s $866 million in online revenues gave it a 10.2 share, up from 9.4 percent in the third quarter. And AOL’s advertising revenues remained flat at $507 million, giving it a 6.0 percent share (down 0.2 percent).

For the purposes of this analysis, I took the total advertising revenues from both Google and Yahoo, including their network revenues paid to affiliates, the online revenues reported by Microsoft, and only the advertising portion of AOL’s revenues. The revenue share figures above are rounded. Below are the absolute revenue numbers, broken down by company:

Update: We’ve updated the chart and table below to reflect more data going back to the third quarter of 2007. While there was an uptick in the quarterly growth rate in the fourth quarter, the 8 percent annual growth rate was still much slower than the 18 percent annual growth rate we saw in the third quarter. The big quarterly jumps began to temper in the fourth quarter of 2007, so that is only now beginning to be reflected in the year-over-year comparisons.