Google says the vast majority of the 1 million businesses that use Google Apps opt for the free advertising supported version. To make the free option less attractive they’ve been quietly lowering the number of user accounts that can be associated with a free account. Now as businesses grow, they’ll be forced to move to the paid version much more quickly than before.

Google says the vast majority of the 1 million businesses that use Google Apps opt for the free advertising supported version. To make the free option less attractive they’ve been quietly lowering the number of user accounts that can be associated with a free account. Now as businesses grow, they’ll be forced to move to the paid version much more quickly than before.

Google Apps is a suite of online applications like gmail, Google calendar, Google Docs, etc. that are packaged and tailored for business use. It’s growing fast – in a recent post where Google announced the opening of a reseller program, the company said that more than 1 million businesses and 10 million users use Google Apps today, and 3,000 new businesses sign up daily. The largest business user, Genentech, has 20,000 employees on Google Apps.

When Google Apps first launched in August 2006 it was free and described as “a service available at no cost to organizations of all shapes and sizes.”

Free for everyone lasted until February 2007, when Google announced a premier edition of the service with more storage and an uptime guarantee. The cost was (and is) $50 per user per year.

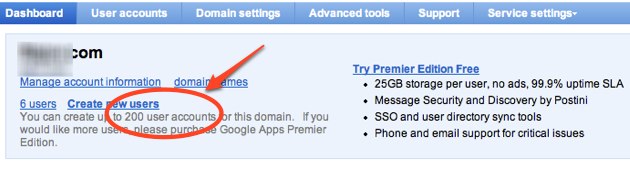

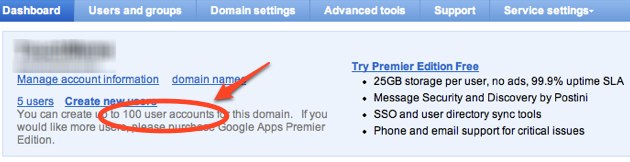

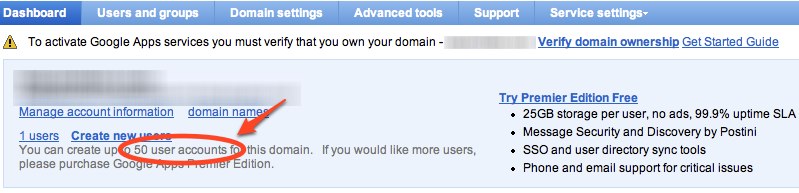

When Google Apps first launched up to 200 user accounts could be created for each business under the free version. But that limit was quietly reduced to just 100 user accounts. And then when the reseller program was announced earlier this month, the limit was cut in half again, to just 50 accounts.

Google also changed the sign up page for Google Apps. The page used to show (screenshot) a comparison between the free and premium versions. Now it only shows the premium version and offers a free trial. To see the comparison chart you have to click the link “compare to standard edition” to see the free and premium versions compared.

The goal is clear – to get more premium accounts that pay $50/user/year. Income growth has slowed considerably at Google and the company is looking for more ways to ramp revenue, particularly newer revenue streams, and control costs. And it’s more than fine that Google experiments with pricing on these products. But they have to remember that they’re not just competing with Microsoft and its expensive exchange server product; they also have cheaper competitors like Zoho and Yahoo’s Zimbra to deal with as well. They may not have as much pricing flexibility as they think.

Update: Dave Girouard, Google’s President of Enterprise, emails to say that before the recent change to limit free accounts to 50 users, admins could request additional users without upgrading. The recent limitation was set to encourage reseller enthusiasm. He also says Google has no plans to further decrease the limit:

I run the enterprise/apps division at Google – we met a couple of years ago at the Apps launch. I read your story this AM on Techcrunch. Just a bit of clarification and explanation for our change. Until just now, we actually had no caps whatsoever on # of users on Apps Standard (ie free version). The 100 and 200 user “limits” you saw were actually just the defaults that showed up there – admins could request any additional number they wanted.

As to the question of our motivation, the reality is a little more subtle. If it weren’t for the reseller program, I can say for sure that we wouldn’t have put the cap on the free edition. The reality pre-reseller is that the vast majority of larger businesses opt for the paid version for all the reasons you can guess (support, api access, ldap synch, etc). So the mere imposition of the cap has a trivial direct impact on our revs. However, with the new channel program designed to attract a big ecosystem of resellers, it’s hard to convince them that this isn’t really an issue – eg that they shouldn’t worry about competing with a free product. Indirectly, we think the cap will help us grow revenues more quickly, because it makes it easier to attract high-quality partners.

We started 2 years ago with the belief that we needed a huge installled base first . . . and that subscription monetization would happen mostly in companies of larger than 25-50 employees. And also that we had a very viable ad-supported product for very small businesses, who tend to think more like consumers (free is good). We designed our approach to get a massive user base, and then to get increased monetization as more bigger companies adopt. This isn’t the same as saying that we want to get companies started on “free” and get them to pay later – that’s a relatively small effect in my view. Both user growth and revenue is in fact accelerating. Maturity of the product accounts for that, though we still have a ways to go.

There’s no reason to believe that the cap will continue to “move down” – we have no plans whatsoever to do that.