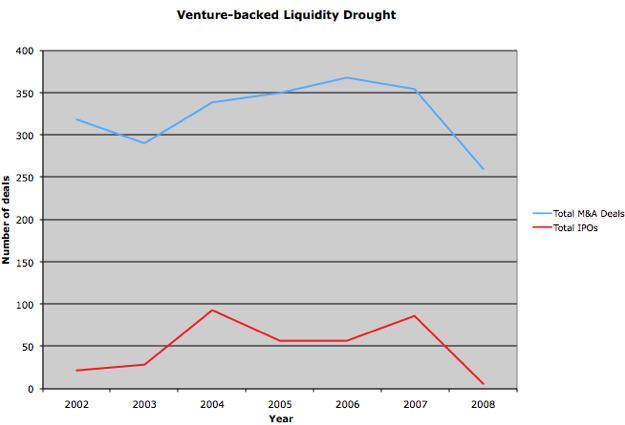

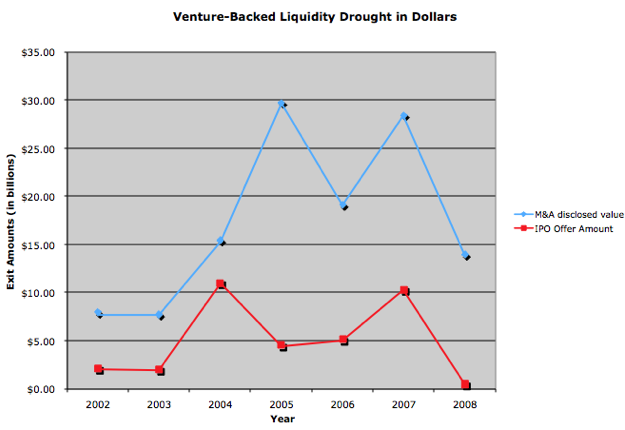

The financial meltdown of 2008 all but shut down venture-backed exits, as we all know. The National Venture Capital Association declared a crisis back in the second quarter, which got worse in the third quarter. This week, the NCVA released its numbers for the fourth quarter and, as expected, they are pretty grim. There were zero venture backed IPOs in the quarter, and only 37 M&A deals (down from 78 in the third quarter). Of the 37 M&A deals tracked by the NCVA, 30 were in IT.

So for the year, that’s six IPOs (down 93 percent) and 260 M&A deals (down 27 percent). The proceeds from those six IPOs brought in $470 million, down from $10.3 billion in 2007. That is the smallest amount of IPO dollars since 1979. The M&A activity was a little better, bringing in $13.9 billion (for those deals with disclosed values). But even that was down 51 percent.

The IPO window was completely closed in 2008, and will likely remain closed throughout most of 2009. That leaves M&A transactions as the only exit for startups. And even those might not rebound until the second half of 2009.