Today’s keynote presentation by Phil Schiller has been widely regarded as a relatively lackluster affair. That isn’t to say it went badly – I’m genuinely excited about some of the new software updates. But the Macworld keynote in years past has been home to some very major product announcements, including the Macbook Air, the MacBook Pro, and perhaps most notably, the first iPhone. Investors have learned to expect big things from Apple every January, and for at least the last four years their reactions to the keynote have weighed heavily on Apple’s stock price.

Except for this year. And that’s no accident.

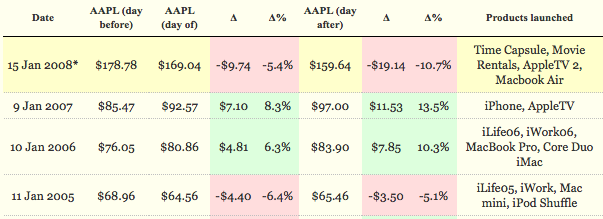

A site called the Keynote Index Fund has tabulated just how big these stock swings have been over the years. In 2006, Apple launched some of its first Intel-based computers, and was rewarded with gains of 10.3% over the two days following the announcement. The next year, the launch of the iPhone and the Apple TV was met with an increase of a whopping 13.5% over the same time period.

But the stock has taken a major hit whenever the keynote didn’t live up to expectations. Last year, Apple released products including Time Capsule, Movie Rentals, AppleTV 2, and Macbook Air – an impressive lineup to be sure, but nothing that could live up to the iPhone release of the year before. The stock subsequently took a 10.7% loss over the next two days.

In the weeks leading up to Macworld 2009, it looked like this year’s show might be headed for a similar fate. Rumors of new products were few and far between, and it seemed like Apple simply didn’t have much to announce. And then Apple dropped the bomb: this would be the company’s last Macworld, and CEO Steve Jobs wasn’t going to be giving the keynote. This spawned countless distasteful rumors regarding Jobs’ health, but it also served to lower expectations. Leading analysts went on to report that “no significant new products [were] expected“. So when Phil didn’t whip out the third generation iPhone this morning, nobody was surprised. The stock dipped a bit, but little more than it would on a typical day.

So what was the damage? A loss of $1.56 (-1.65%). Nothing to cheer about, but looking at years past, it could have been much, much worse. Granted, the figures stated above were averaged over two days, so we won’t know until tomorrow just how big the swing was, but given today’s performance I won’t be surprised if any change is relatively modest.

It’s unlikely we’ll ever know if Steve Jobs pulled out from the show with the direct intention of lowering expectations. But can you picture him presenting a keynote whose major highlights were an 8-hour laptop battery and some software updates? I don’t think he could either.

Update: Apple closed down -2.01 (-2.16%) on the day following the keynote. Again, nothing to celebrate, but compared to past years it could have been worse.