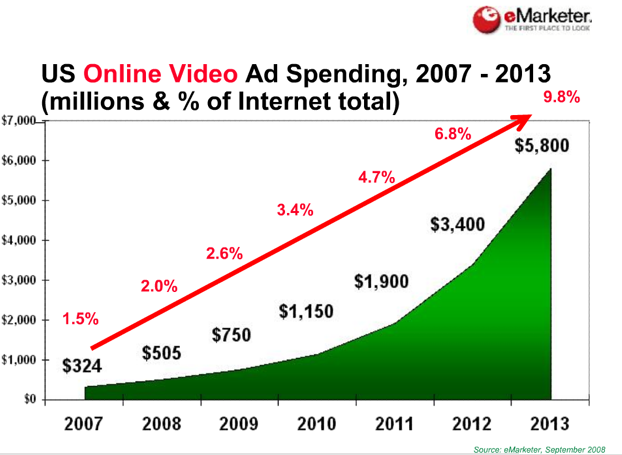

Here is the stark reality of online video: nobody is making much money and the enthusiastic projections for online video advertising going from $500 million in 2008 to more than $5 billion in five years will undoubtedly be pared back in the coming weeks as analysts revisit their numbers. (Those numbers are from August—eMarketer).

The writing is already on the wall. YouTube is resorting to selling off video search results to the sexiest bidder and just today announced that it is extending overlay ads in YouTube Partner videos to embedded videos on other sites (previously these would only show up on YouTube itself). It is pulling out all the stops to try to get those revenues flowing. Meanwhile, smaller video startups such as Veoh and Revsion3 have already cut back on staff and shows in order to survive. So you can throw this slide out the window:

There is plenty of video inventory, just not a lot that advertisers want. Although YouTube streams more than 5 billion videos a month, estimates bandied about are that only 3 to 4 percent of those videos have ads. That is still a lot of videos, but it means that much smaller competitors such as Hulu that focus only on professionally-produced, advertiser-friendly videos are much closer in revenues to YouTube than the raw number of video streams would suggest.

But even the videos produced and distributed online by the TV networks are bringing in only a fraction of the advertising dollars that they do on regular TV. NBC CEO Jeff Zucker’s fear that the Web will turn “analog dollars” into “digital pennies is coming true. According to Dean Denhart, the CEO of BlackArrow (a company that provides an ad-management system for on-demand video across both cable and the Web), mainstream video fetches an average of about 50-cents per thousand viewer per hour watched on broadcast and cable TV, compared to 5 16 cents per thousand viewer per hour watched for the same video on the Web. [Correction: I got this slightly wrong. The BlackArrow comparison between the value of video on TV and the Web is not per ad impression, but rather per hour of video watched, and has been amended in the preceding sentence. The correct comparison is 50 cents per viewer for TV versus 16 cents per viewer for the Web].

In other words, TV and media companies can make ten times as much by putting a video on TV than they can by putting it on the Web, even if that video attracts the same size audience. Online video startups can look at that as an opportunity to close that gap, but they should also realize that the Web is not the only game in town. In fact, cable companies are striking back by gradually shifting up their video-on-demand channels to a bigger mix of free, advertising-supported video. Cable’s answer to Youtube will be more video-on-demand channels with better videos that advertisers will line up to buy ads for at ten times the price they are willing to pay for ads on YouTube, or Hulu for that matter.

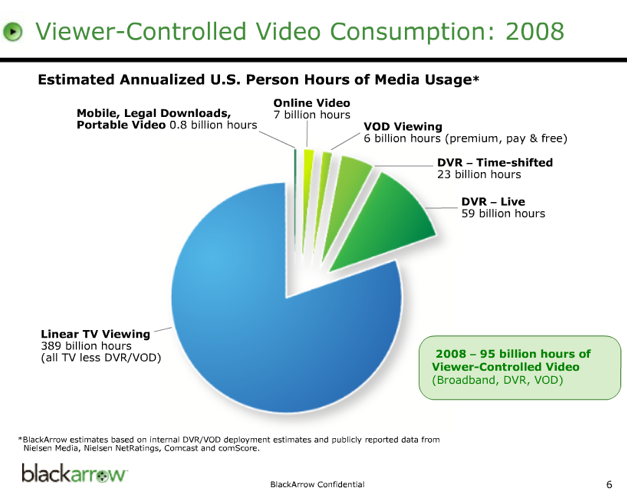

Here’s a slide Denhart likes to show that puts things into perspective. In 2008, he estimates that people in the U.S. watched 389 billion hours of plain old TV. That compares to 95 billion hours of on-demand TV, which he breaks up into live DVR (59 billion hours), time-shifted DVR (23 billion), cable and satellite video-on-demand (6 billion hours), online video (7 billion hours), and digital downloads (800 million hours). So of all 484 billion hours people will spend watching video in the U.S. this year, only 1.4 percent will be online video.

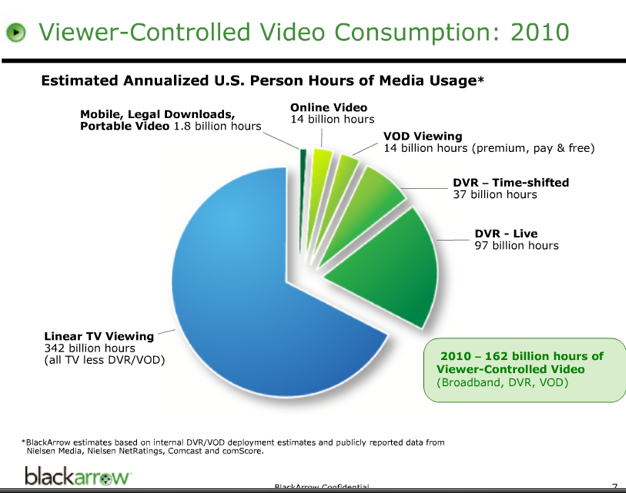

By 2010, Denhart thinks the overall viewer-controlled portion of the video pie will increase from 20 percent of all time spent watching videos to 32 percent. And both online video and video-on-demand will both grow to 2.7 percent of time watched, or about 14 billion hours each. Which segment do you think will be making more money from advertising in two years?

Last month, I co-moderated a Beet.TV roundtable on online video where we discussed some of these issues. It was clear that the budding online video industry is still trying to figure out the best way to proceed to profitability. Below are two clips from that event.

In the first clip, Brightcove exec Adam Berrey suggests that focusing too much on video advertising inventory per se (pre-rolls, post-rolls, etc.) is the wrong way to think about it. Instead media companies should think more holistically about selling their audience instead of their inventory. And video is just one way to do that. Also brands that use online videos to tell stories about their products may end up creating closer connections to consumers than simply sticking a 15-second commercial on a million videos produced by somebody else.

In the second clip, MSNBC.com president Charlie Tillinghast paints a dour picture of the exit scenarios for Web video startups. Web video startups hoping to get bought by a bigger media company will likely be disappointed by the price they can get. And it is no longer enough to simply have built up an audience that a startup then can then sell to a bigger media company. The only startups that will be bought are those with “demonstrable” revenues or those that have attracted desirable audience niches that the bigger companies lack.