At a recent presentation at Harvard Business School, Adeo Ressi argued that the VC model is broken. That is nothing new for Ressi, who is the founder of the VC-rating site theFunded. He is kind of like the Nick Denton of the VC world, always saying that the sky is falling. It’s just that at this moment he happens to be right.

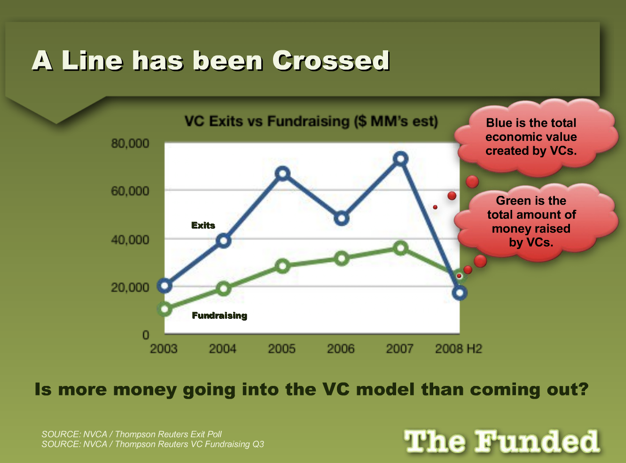

The slides from his presentation are embedded below, but really all you need to look at is the one above. It shows that the money going into VC funds is now more than the money coming out of VC funds. That line was crossed last June and there is no going back anytime soon.

The big institutional investors who tend to put the most money into venture funds as limited partners are hurting right now. They’re other investments have gone south, they are over-leveraged, and there is buzz that some are pulling back from their commitments to venture funds. They certainly aren’t eager to pour in more money, especially when the net returns just aren’t there any more.

When the lines cross over again, we can all relax. But until then, it won’t be just startups that need to tighten their belts. VCs are on notice too. Their once-flush investors are now squeezing every penny. And some VC funds just won’t make it.