Who knew you could auction real diamonds much like you could sell your stamp collection on eBay?

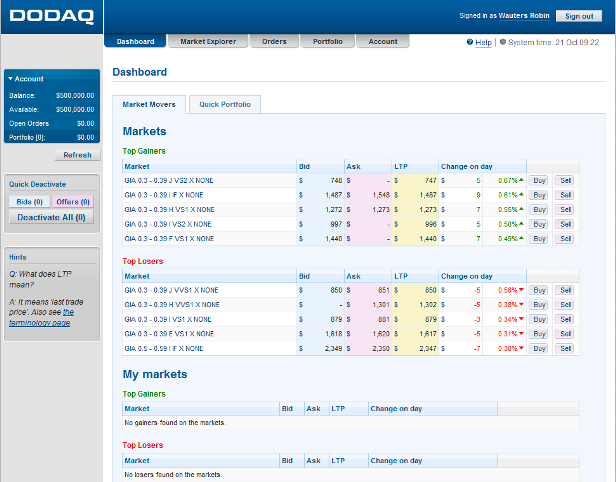

Well, not really, but pretty close. DODAQ has launched a demo version of what appears to be the first ever online diamond exchange, enabling professional traders to buy, sell and hold certified polished diamonds like stocks. The company offers a two-way auction for traders and facilitates electronic transactions with real-time tradable pricing.

Now, it’s been a while since I’ve traded any diamonds, but according to company management the mechanism is bound to make waves in the industry. The way it works now, is that there’s no real fixed price for polished diamonds. The few inventory lists that give an idea of which stones are out there, are often inaccurate or incomplete. Buyers and sellers pretty much agree on pricing based on a scheme that’s distributed on a weekly basis, but without any real, dynamic transaction data that can be used for benchmarking.

DODAQ aims to provide a centralized, global meeting place that enables basically anyone to trade or invest in diamonds, with transparency on rates. The platform also allows outsiders to start investing in diamonds and set up a virtual holding. Obviously, the biggest challenge for the company is building a market place so secure that it’s able to convince industry professionals diamonds can effectively be traded online ‘like any other commodity nowadays’ (not my words). In order to brush off skepticism, the authenticity and actual existence of every stone is graded and guaranteed (including insurance), and the polished diamonds are locked in a vault facility together with their certification documents.

DODAQ acts as a custodian, so it charges a fee for the vault service and takes a commission of maximum 1,5% on any transaction. You can sign up for a demo account and play around with $500,000 on a dummy balance. I embedded a video below that outlines what DODAQ does in a nutshell.