Mint, the personal finance startup that won last year’s TechCrunch 40, has launched a host of new features including investment tracking, 401k managment, and more flexible budget sheets. CEO Aaron Patzer says that the new features finally make Mint a one-stop place to get an overview on your entire financial portfolio, and will drop the site’s ‘Beta’ label accordingly. Patzer also notes that in the past few weeks of economic turmoil, Mint has been seeing its highest traffic ever -with registrations up 100% – as users scramble to save money wherever they can.

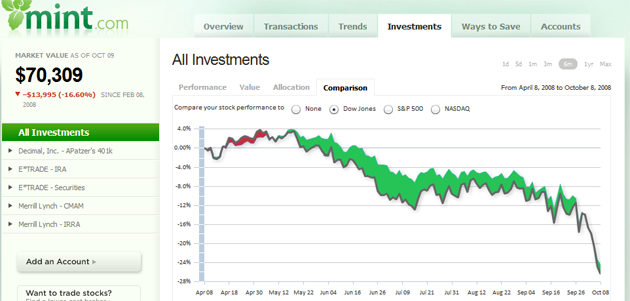

Mint originally released its investment tracking functionality to a small portion of its users, and will now be expanding the feature to everyone. Users can track their Brokerage, IRA, 401k and 529 accounts, and can drill down in each to see how their investments are performing relative to the market average.

The site is also opening an entirely new 401(k) management center, where users can identify present and past 401k accounts. Patzer says that old 401(k)s from past employers can lead to regular maintenance fees, which Mint will help users avoid by switching old accounts to rollover IRAs.

Finally, the site is also introducing what Patzer says is the site’s most oft-requested feature: user-defined transaction categories. Previously users of the site’s budget management tool (which automatically categories purchases depending on where they occur) were restricted to a set of options defined by Mint. Now users will be able to enter their own categories and set up custom rulesets.

So where does Mint go from here? Patzer says that Mint will soon be enhancing its mobile options, with a new SMS feature in the next few weeks and an iPhone application around the end of the year. Unfortunately, making transactions on Mint (be it to pay bills or execute trades) still isn’t possible and won’t be for some time, which means you’ll have to go elsewhere to move your money around.