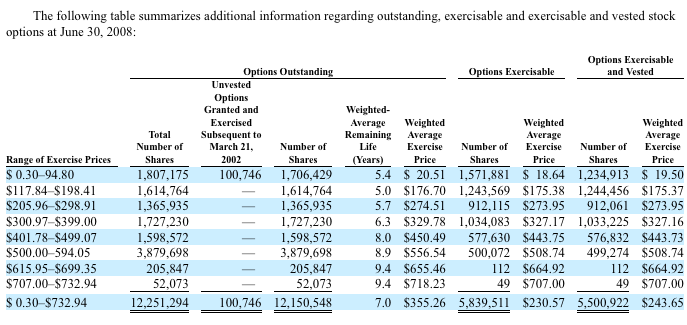

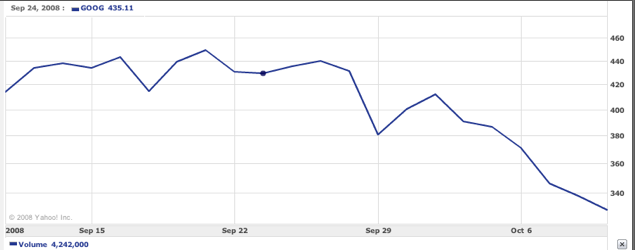

The entire stock market is taking another drubbing today, and Google is no exception. Its shares tried to rally in the morning, but are now trading below the $329 they closed at yesterday. That’s a key price level Google employees are watching because a huge chunk of their options (1.7 million across the company) were granted with a weighted average exercise price of $329.78. The options are worthless under that price. In addition to that, there are another 5.7 million options that were granted at weighted average exercise prices of $450 and above. (see table below). All told, 61 percent of Google’s stock options granted to employees are currently under water.

The rest of Google’s stock options become worthless at the average exercise prices of $275, $177, and $21 (for pre-IPO employees, who don’t have much to worry about). All of these numbers com from Google’s second quarter 10-Q and don’t reflect any options that may have been granted in the third quarter. (Google’s third-quarter earnings announcement is next week).

Only eight days ago Google’s shares were trading at $411 and three months ago they were above $450. In that time, a lot of paper wealth has disappeared and along with it incentive for many recent hires to stay. Of course, the stock could rally and everything will be honky dory again, but if Google’s market cap is being fundamentally reset along with the rest of the stock market, it could face some serious retention issues in the coming months. The free food and transportation are great perks and all, but let’s get real here. Without the financial upside those stock options represent, Google employees will start looking elsewhere.

It is a danger if the stock does not recover. On the other hand, if the economy truly is spiraling into a recession and capital is drying up for new startups, frustrated Google employees might not have anywhere else to go.

Update: How many Google employees are completely underwater with their options? As I understand it, Google grants stock options to employees during the week they are hired. The last time the stock was this low was almost exactly three years ago. So anyone hired since October, 2005 is pretty much under water. That is 75 percent of all current employees (Google had 5,000 employees three years ago, and now has about 20,000).

Update 2: Google shares rallied a bit at the end of the trading day, closing at $332, just above the watermark for some of those options. Next week is earnings. Will it bring another plunge or a rebound?