Tech stocks continue to get creamed this morning, led by Google, whose stock is now officially a dropping knife (i.e., good luck catching it). Shares are down 5 percent so far today to about $353 (at one point they dipped as low as $350. That’s more than a $50 drop since Friday and the lowest the stock has traded since March, 2006. The question on investor’s minds: How low can it go?

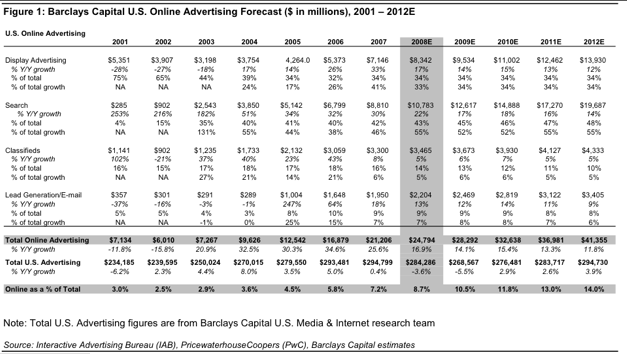

Even though Google is the best positioned Internet (or media) company to weather a slowdown in advertising spending, analysts have started cutting back their earnings estimates for the company. As for overall ad spending, Barclays Capital is trimming its estimates for both overall and Internet ad spending. Total ad spending in the U.S. (including cable and broadcast TV, radio, newspapers, magazines, Yellow Pages, direct mail, Internet, and outdoor) it forecasts will decline 3.6 percent this year to $284 billion and then another 5.5 percent in 2009 to $269 billion. Of that total, Barclays is still estimating that Internet ad spending will grow 17 percent to $24.8 billion in 2008. But that represents a $1.4 billion haircut from its previous 2008 estimate of $26.2 billion. (It expects 2009 Internet ad spending to grow another 14 percent to $28.3 billion).

Although search advertising is most likely to hold up in the coming advertising recession, it’s growth rate is expected to slow down. Nevertheless, display advertising is expected to get the worst of it, which means less growth for Google’s DoubleClick business, but should hurt Yahoo, AOL, and Microsoft more. That’s why some analysts are still bullish on Google. In a note today, Barclays Doug Anmuth writes:

- Although we believe that online advertising will continue to benefit from the secular shift in advertising, we are lowering our 2008 online advertising forecast and our projections through 2012 given the current macro-environment, indications that a broader economic recession lie ahead, and the likelihood of sustained disruptions across some of the largest online advertising verticals.

- In this note we highlight five current trends that we believe will shape the online ad environment going forward: 1) pressure on display, as expected; 2) platform launches following 2007’s acquisitions; 3) privacy issues impacting behavioral targeting growth; 4) the shift to performance pricing; and 5) rich media and video continue to outperform.

- Overall we believe Search is the strongest vertical within Internet advertising due to its success based nature and focus on ROI, as such we continue to believe that the biggest beneficiary of growth in online advertising remains Google given its leading position in search and its multiple legs of growth over time including display, video, and mobile.

Despite his optimism, it’s not all good news for Google. Anmuth has search at 55 percent of Internet ad spending this year, Display at 33 percent, lead gen/email at 7 percent, and classifieds at 5 percent. But next year, he has search losing three points of market share to the other sectors. Here is his revised ad spending model (click for a larger image):