Business expense accounts may sound glamorous, but for most frequent travelers they’re more of a hassle than anything. Sure, there’s always the novelty of being able to go out to to dinner on the company’s dime, but this wears thin after a few days of stuffing your wallet full of receipts.

Expensify, the startup that took second place at TC50’s DemoPit, is hoping to ameliorate these issues as much as possible by keeping track of your expenses for you. CEO David Barrett says that while solutions exist for the top 3% of businesses – namely large companies with hundreds or thousands of employees – the remaining 25 million American businesses are left to fend for themselves with paper receipts and annoying Excel spreadsheets. The site launched this week, and is offering the service for free (you won’t have to pay its 3% surcharge) to the first 1000 users who sign up here.

To use Expensify, you first sign up for an “electronic payment card” – essentially an Expensify-branded MasterCard that is linked to your original credit card. This electronic payment card is acting as a middle man, tabulating all of your purchases on the road and immediately charging your original credit card for whatever you spent (you don’t lose out on your frequent flier miles, and you don’t get an extra monthly bill).

Expensify allows you to submit photographs of your receipts as you get them, which are automatically attached to the corresponding purchase in your account history (assuming your business will accept a photo in lieu of the physical receipt). You can submit photos using either a native iPhone application or using a dedicated Email address from any camera phone.

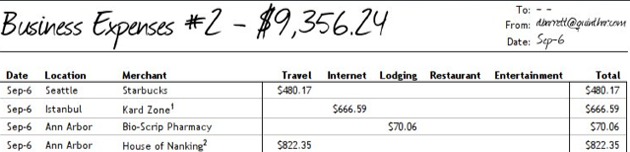

After logging onto Expensify’s website, you can browse through your purchases, categorizing and labeling them for future reference. Once the trip is concluded, the site will use this list to generate a PDF list of expenses for your company, which can optionally be emailed, imported into Excel, or printed. If you choose to submit the record online, your manager will have the option of paying for your expenses immediately using a credit card or bank information, and Expensify will reimburse your original credit card immediately.

To generate revenue, Expensify tacks on a 3% surcharge to all items purchased with the electronic payment card. This sounds a little steep to me for what it does – you’re still required to photograph your receipts, and the online interface isn’t that much better than the ones seen on most banking websites. But Barrett says that the service easily pays for itself by saving hours of times lost tabulating these expenses, and the site already has a number of customers chomping at the bit. This is a huge market, provided Expensify can find the ideal price point and can convince users to add yet one more card to their wallets.

Another service in the receipt/expense account space is Shoeboxed, which scans in any receipts its users submit through snail-mail for easy management online.