At a time when most social networks are still trying to figure out how to make money from advertising, one social network is bucking the trend. LinkedIn, the social network for business professionals, has so much demand from advertisers that it will be launching its own ad network on Monday. In conjunction with ad network Collective Media (which targets high-end media sites), LinkedIn will let other select sites target its users when they visit those partner sites.

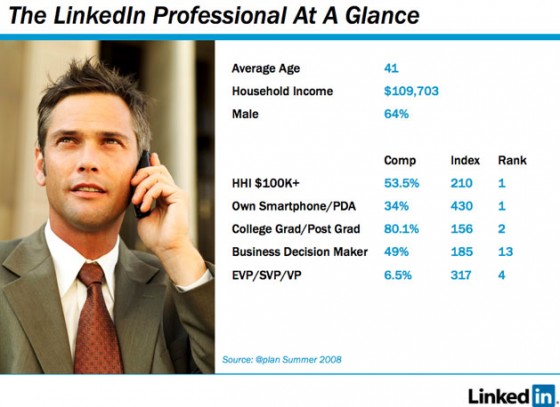

Most social networks have a hard time selling ads at more than $1 CPMs (cost per thousand impressions), but LinkedIn’s rate card shows display ads starting at $30 CPMs and going up to $76.50. Text ads range from $12 to $20 CPMs. Even with the regular discounting from the rate card that many advertisers might recieve, LinkedIn is still doing much better than most social networks. That is because it has a more desirable audience that advertisers want to reach.

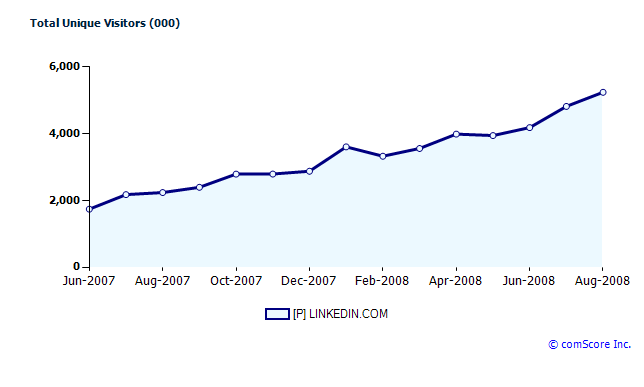

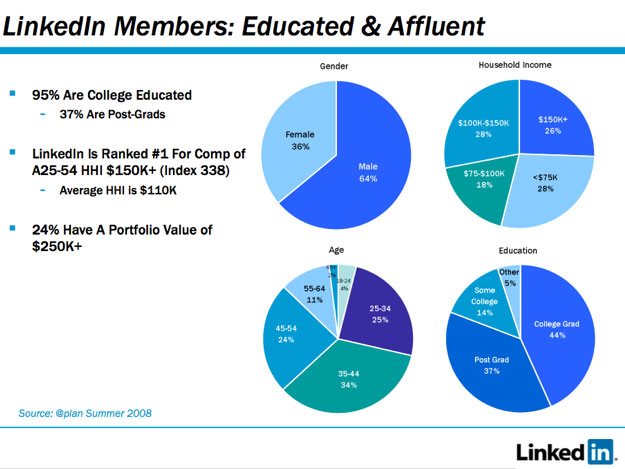

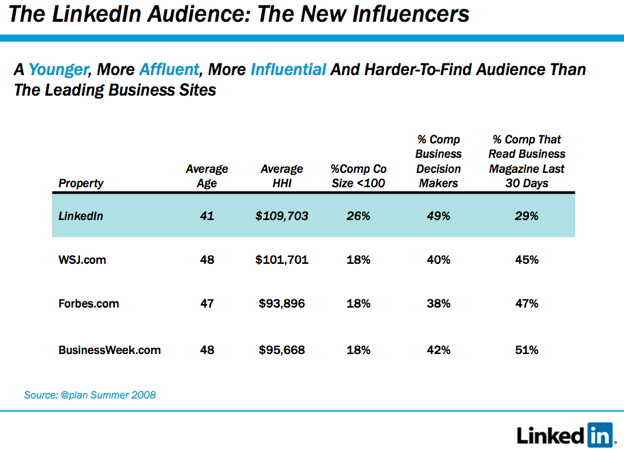

LinkedIn claims 27 million registered users. According to comScore, 5.2 million from the U.S. visited the site in July (8.7 million worldwide). LinkedIn claims that the average household income of its members is $110,000, 64 percent are male, the average age is 41, and 49 percent are decision makers. (In contrast, the average Wall Street Journal reader, according to LinkedIn, makes $102,000 per household, is 48 years old, and only 40 percent are business decision makers).

LinkedIn already sells ads against this audience on its own site, targeted by industry, seniority, company size, geography, gender, and number of connections. Now, it will expand that targeting to other partner sites. Publishers will have to apply to become part of the ad network, but LinkedIn will probably try to sign up some of its existing content partners such as the Businessweek, CNBC, and the New York Times.

Whenever someone visits LinkedIn, a cookie will be placed on their browser, which will identify them as a LinkedIn member when they visit a partner site. Personally identifying information will be removed, but members will be grouped into different, targetable categories. As with Yahoo and Google’s similar ad-network targeting, anyone will be able to opt out of this program.

It is becoming increasingly obvious that the social networking game is not just about who has the largest audience, but also about who has the most valuable audience. The dominant social networks like MySpace try to maximize advertising dollars by focusing on the most lucrative geographic markets.

LinkedIn knows it has a valuable audience, and now wants to sell access to that audience to others. Although LinkedIn will always make more money off the ads it shows on its own site (since it doesn’t have to split those ads three ways with Collective Media and the partner sites). Perhaps LinkedIn realizes that it will never become a big enough site on its own to justify its recent $1 billion valuation. (Although employees can only sell shares at a $500 million valuation). This will create incremental revenues for LinkedIn. And for publishing site partners it offers a potentially more lucrative set of remnant inventory that it can throw ads up against.

Is this the future of all destination sites—to become ad networks and sell their audiences everywhere to the highest bidder?