Google pulled in $5.37 billion in revenues last quarter, and $1.25 billion in net profits (nearly ten times what Yahoo made last quarter). Yet behind the consistently amazing financial performance, a few chinks are beginning to appear in Google’s armor. The biggest one may be the increasing gap between its organic revenue growth and its total revenue growth.

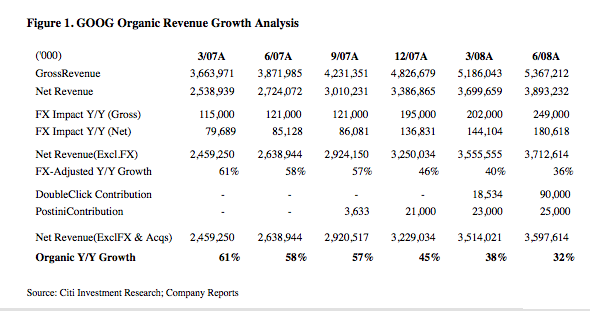

Google does not break out its organic revenue numbers (the revenue from its core businesses, not including contributions from recent acquisitions, investments, interest, or foreign exchange fluctuations). But in a note put out on Friday, Citi analyst Mark Mahaney gave his estimates of Google’s organic revenue growth. He warns, “We have seen steady and material deceleration in GOOG’s organic revenue growth,” and he expects that trend to continue in the third quarter as well. (Even so, he still reiterates his buy rating on the stock).

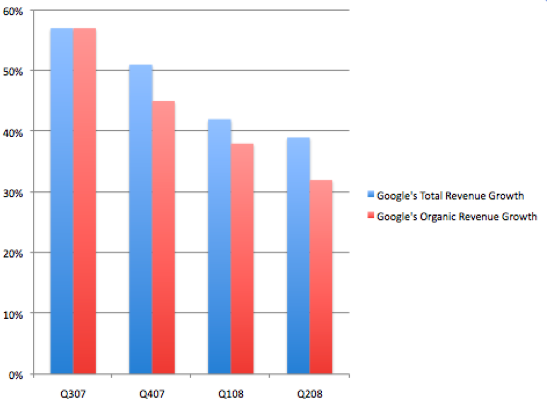

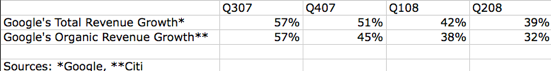

I’ve put his organic growth rate estimates together with Google’s reported total revenue growth rates for the past four quarters in the chart and table above. In the third quarter of last year, both growth rates were the same: 57 percent. By the second quarter of 2008, Google’s total revenue growth rate had settled down to 39 percent, but its estimated organic growth rate was significantly lower, at 32 percent.

What this suggests is that Google’s core search advertising business may be decelerating faster than a glance at Google’s quarterly income statements would indicate. It also highlights how important it is for its biggest acquisition, DoubelClick, to make up for the slack. And, of course, it would be nice if Google could start making money from its underperforming businesses such as YouTube, Postini, and Google Checkout (some of which, themselves, were acquisitions). Mahaney estimates that DoubleClick contributed $90 million in revenues last quarter, and Postini contributed $25 million.

Update: Here is Mahaney’s detailed analysis.