The music industry’s attempts to create its own digital distribution business is like a bad horror movie. It just keeps coming back no matter how badly bludgeoned it gets. Back in 2001 in response to Napster, the music labels launched two competing music download sites, PressPlay and MusicNet (the latter became a white-label music service called MediaNet. Meanwhile, Pressplay was bought by Roxio, and formed the basis for the current version of Napster). Both were utter failures.

The music industry’s attempts to create its own digital distribution business is like a bad horror movie. It just keeps coming back no matter how badly bludgeoned it gets. Back in 2001 in response to Napster, the music labels launched two competing music download sites, PressPlay and MusicNet (the latter became a white-label music service called MediaNet. Meanwhile, Pressplay was bought by Roxio, and formed the basis for the current version of Napster). Both were utter failures.

Then in 2007, in response to iTunes, Doug Morris at Universal Music had the brilliant idea of bundling music subscriptions into the price of digital music players. The effort was called TotalMusic, and the idea was to get all the record labels on board, until the Department of Justice launched an antitrust investigation that killed the idea. Or so everyone thought.

Multiple sources in the Web music industry (including two CEOs and another executive) have told us that the music labels are mulling over another attempt at creating their own digital distribution business, or at least one they can control. Details are sketchy, but the buzz is increasing around a project to create a free, advertising-supported streaming service that would be licensed or white-labeled to other Websites. Each stream would link directly to a paid digital download. Some believe that a revived TotalMusic and this project are one and the same.

TotalMusic, Like, Totally Doesn’t Want To Die

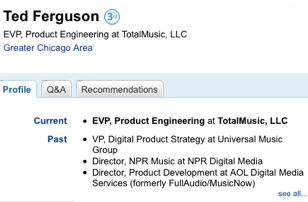

Indeed, TotalMusic lives on, although in a different form. A search on LinkedIn for “TotalMusic” returns four people who list it as their current employer  (Ted Ferguson, Troy Denkinger, Robert Broome, and Derek Reeve). All four live in Chicago and all four previously worked at MusicNow, another music service that changed hands between Circuit City, AOL, and ultimately the new Napster (not a good omen). A couple job listings, like this one posted on July 15 for a senior software engineer, describes TotalMusic as being based in Herndon, VA (near AOL old headquarters):

(Ted Ferguson, Troy Denkinger, Robert Broome, and Derek Reeve). All four live in Chicago and all four previously worked at MusicNow, another music service that changed hands between Circuit City, AOL, and ultimately the new Napster (not a good omen). A couple job listings, like this one posted on July 15 for a senior software engineer, describes TotalMusic as being based in Herndon, VA (near AOL old headquarters):

TotalMusic, LLC is a new digital music platform offering the integration of music discovery, streaming and downloads into a wide variety of online and mobile environments. We have solid financial backing and a staff with decades of combined experience in online music.

Compensation is competitive, and the work environment is highly distributed with most members of the team telecommuting, however, our Headquarters is located in Northern Virginia, and have a group in Chicago and Boston. So if you prefer an office environment, Northern Virginia should be your choice.

Free, As in Music

The idea of combining ad-supported streaming with paid downloads is very similar to the upcoming MySpace Music (due to launch next month), except that it will be available to other sites. In that sense, it is closer to what Rhapsody has done, powering music streams for Yahoo Music, iLike, and MTV.com, and trying to up-sell full subscriptions or paid music downloads.

Full-track, on-demand, advertising-supported music streaming (as opposed to randomly-sequenced Internet radio) is gaining steam as a business model. The music labels have licensed their catalogs for uninhibited streaming to imeem and MySpace Music. And a number of other sites, including Lala and Last.fm, have signed more limited deals that still provide access to a broad range of artists. For example, Rhapsody offers a limited version of free streams (25 songs a month) to their songs.

What the music industry should do is make music streaming free. Treat it like a marketing expense to sell digital downloads, concert tickets, and other items. That’s probably not going to happen. But what could happen, and what Web music startups are hoping for, is for the music industry to lower its licensing fees for streaming music.

Or At Least Disruptive Pricing: The $1 CPM

Right now the going rate for streaming music is a penny per track, which comes to an effective CPM (cost per thousand) of $10. That means that music streaming Websites need to be able to charge more than $10 CPMs just to cover the music licensing. And $10 CPMs are not economical. A $1 CPM would make more sense.

As one music startup CEO says, “The only guys who have negotiated terms are guys who have gotten sued.” That is certainly true for imeem and MySpace. With others, the threat of a lawsuit might have been enough to bring them to the table. Although, interestingly, as part of its deal with Warner Music or some time after, imeem received a $15 million investment from Warner, it was revealed today in Warner’s quarterly SEC filing. (Warner also invested $20 million in Lala).

Yet even imeem—which attracts 26 million unique visitors a month to its site, according to comScore, and claims 70 million to 100 million total uniques if you add up its widgets all over the Web—does not expect to make money based on ads related to streaming music alone. It is trying to create a bigger experience that includes videos and photos, and sells other forms of display advertising and sponsorships. MySpace Music, similarly, has its own economies of scale.

For everybody else, offering on-demand streams won’t become feasible until the licensing fees come down. Whether or not TotalMusic is the answer they are waiting for remains to be seen. But don’t count on it. Industries are rarely able to disrupt themselves.

Horror Stories Tend To End Badly

Another, more sinister strategy could be to simply continue to make life difficult for other music streaming services, and let TotalMusic come out with its own a cost-advantaged model. This would be aimed squarely at iTunes as well.

Although it is actively being developed with a rumored time horizon of three to six months, TotalMusic could end up being just a hedge. One source believes the project has yet to receive the final green light from the music-label bosses.

And even if TotalMusic does launch with a disruptive economic model, there are still the antitrust issues to deal with. Since there are only four major music labels, anything that smacks of price-fixing or collusion will be torn down by the Justice Department. The labels need to be very careful about this. (One story I heard: when MusicNet was forming itself among the record labels, it had to rent out an entire hotel floor with a different label in each room, and the lawyers had to go from room to room to seal the deal because the music companies couldn’t be in the same room together).

TotalMusic needs to get around the collusion issue somehow, while still offering a comprehensive catalog. The music industry is desperate to figure out how to shift from physical to digital distribution and it will just keep trying things until it is all spent out. But like any good horror movie, there will always be another sequel.

(Photo by darkpatator).