In February a well backed startup called YouNoodle said that they were developing a product that would accurately predict the future success of startups based on an analysis of the business and the founding team. Much like a credit rating tells creditors how likely an entity is to pay off debt, YouNoodle aimed to tell investors how likely they would be to see a return on their investment, and would even go so far as to estimate the exact valuation of a startup a few years into the future.

We were skeptical, to say the least. Particularly because the product was being announced while still in development.

Now YouNoodle is preparing to launch the predictor tool (sign up to be notified here). CEO Bob Goodson let me test the service out last week and shared some of the early results with me.

I’m still skeptical, but I love the valuation prediction for TechCrunch ($87.4 million), and I have to admit that some of the predictions are within a stones throw of accurate. And if people can be convinced that this is a useful way of understanding if a startup team has a chance of succeeding, it could become part of Silicon Valley culture.

The Prediction Tool

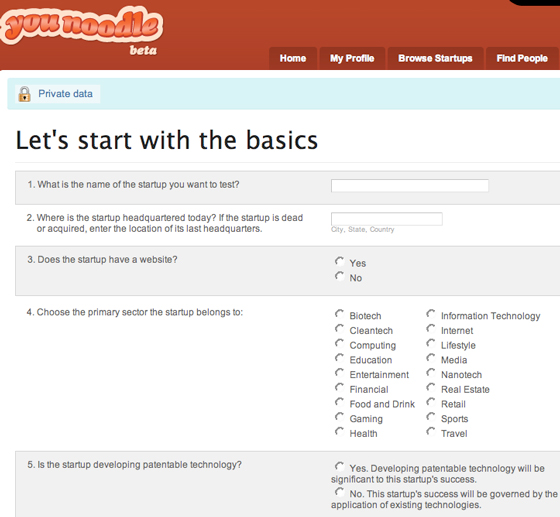

YouNoodle collects a lot of data on startups to make the prediction – the questionnaire takes a good half hour to properly complete. YouNoodle aims to make the prediction right before the first round of funding for a company. So one way to test it is to enter information about a more mature startup that was true prior to funding, and see how well it predicts the actual results.

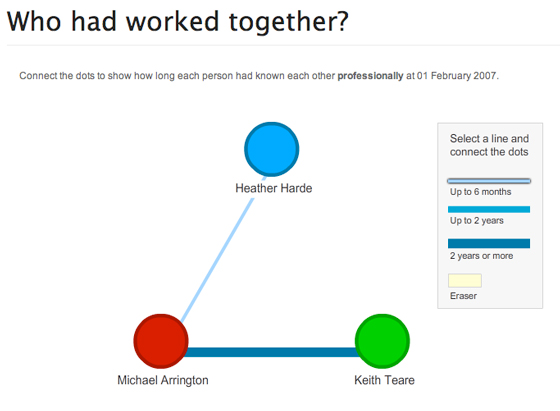

The key factors in determining likelihood of success, says Goodson, are the team, financial factors, the concept and advisors. Details on the education, entrepreneurial experience and other information founder and key employee. The tool wants to know everything. For the founders, their age, education, previous startups (and how they did), and their long term relationship to the other founders. For the concept, YouNoodle gathers information on the business idea (probably extracting keywords for analysis), where it’s located, and lots of other data.

YouNoodle then churns all that data and assigns the company an index score from 1-1000 as well as a valuation estimate three years down the road. YouNoodle has tested and fine tuned their algorithm with 3,000 startups, Goodson says, and the results are “highly statistically accurate.”

As I said, TechCrunch’s valuation prediction based on 2005 information is just over $87 million. I won’t comment on that (woohoo!), but here are some other predictions, all made with data on the startups that was true prior to any funding:

Slide: $124 million (actual: $550m)

RockYou: $71 million (actual: $250m)

Mahalo: $118 million

Powerset: $104 million (actual: $100m)

Cuil: $95 million

Twitter: $110 million

Friendfeed: $86 million

Given that the information used to make the predictions was limited to that available prior to any funding of these companies, the data is both interesting and accurate enough to be useful. Slide and RockYou, for example, aren’t accurate, but the algorithm did predict success and it also got the relative valuations almost perfectly correct. Powerset was accurately predicted, and we’ll have to wait and see how Cuil and Mahalo do. Twitter’s valuation is probably close to accurate.

More examples: YouNoodle predicted that Google would be worth just $88 million three years after it was founded, which is lower than their private valuation at the time but now way off. Facebook’s valuation was predicted at $111 million, which is way off of its actual valuation. But the key is that YouNoodle would have predicted huge successes for all of these companies based on the exceptional teams put in place at the very early stages.

The average three year predicted valuation for student startups from top ten universities is about $360,000.

So the big question is, how does YouNoodle predict it will do based on its own algorithm? Goodson says it thinks YouNoodle will be worth $96 million in 2010.

How YouNoodle May Be Used

Goodson says he will provide the prediction algorithm for free to startups, even giving them a “certificate” showing their index score and predicted valuation (the one for TechCrunch is the top image above). If third parties want official access to the certificate they’ll be asked to pay (just as creditors are asked to pay for official credit reports). For now the service is being provided completely for free.

While the algorithm seems to do a good job of identifying teams with a high likelihood of success, it’s not clear to me that it does a better job than an experienced VC would be able to do on their own. YouNoodle is also basing predictions on historical data, and in a rapidly changing world that is consistently disrupted by new technologies, those predictions are very hard to make. Humans who are on top of recent developments can make subjective decisions that are far more likely to be accurate than an algorithm.

But YouNoodle is also dispassionate, and can therefore make decisions outside of the emotional world of startup investing. Venture capitalists are, despite their appearance, fairly risk averse people. If YouNoodle backs up their instinctive reaction to a startup they may be more likely to invest. And they may also walk away from an investment they like if YouNoodle says it’s destined to fail.

At the very least YouNoodle is going to add a fascinating layer to the conversation. The company has raised one round of financing (they aren’t disclosing the amount raised) from Max Levchin, Peter Thiel and The Founders Fund. In addition to Goodson, key employees include Kirill Makharinsky and Rebeca Hwang.