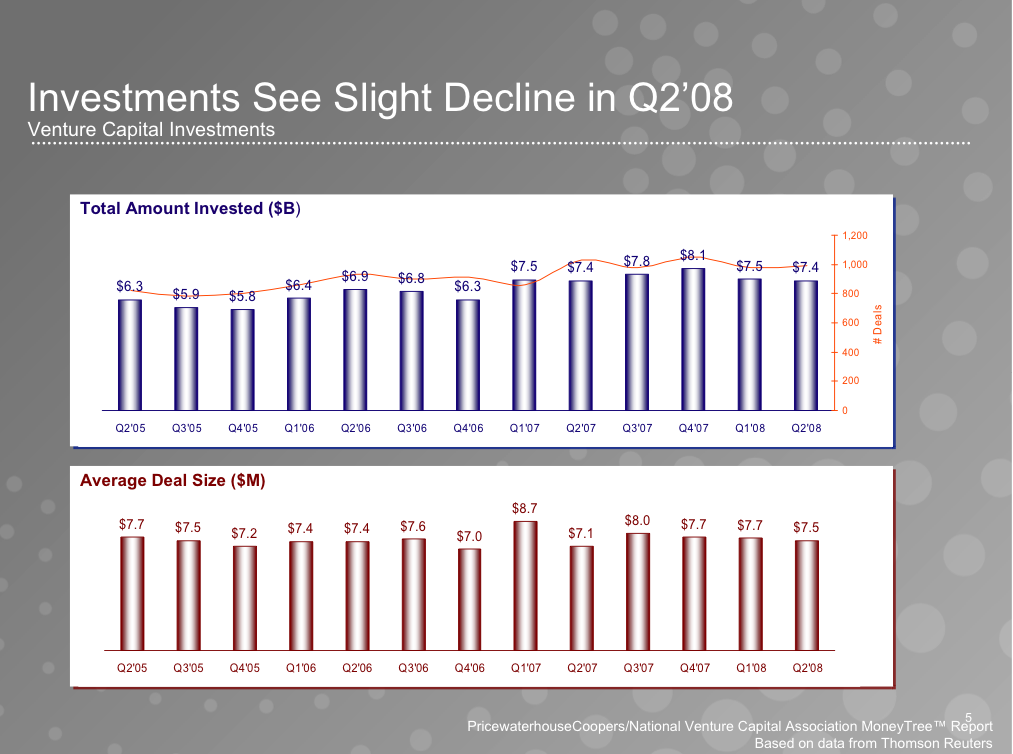

Second quarter data is out on venture deals from the National Venture Capital Association and PriceWaterhouseCoopers. Despite the IPO market drying up completely, the What-Me-Worry crowd on Sand Hill Road keep pumping money into venture deals at a steady pace. Venture capitalists invested $7.4 billion last quarter in 990 deals, compared to $7.5 billion in 997 deals during the first quarter (a number that looks like it was revised upwards from the $7.1 billion the same group originally reported last April). The average deal size last quarter was $7.5 million. (Click on the charts for bigger images).

The amount of money going into first-time financings is declining, with only 22 percent of VC money going to early stage deals. Late-stage and expansion deals are attracting more capital, a trend we saw last quarter as well. These deals are generally deemed more safe than first-time deals since these companies are further along and some of the early risks have been taken off the table.

Software is still the biggest sector attracting VC funds ($1.3 billion), followed by biotech ($1.1 billion), but both those sectors are seeing a slowdown in investments (down 19 percent and 14 percent year-over-year, respectively). The only sectors that saw increases was energy (up 102 percent year-over-year to $1.2 billion) and media (up 23 percent to $586 million).

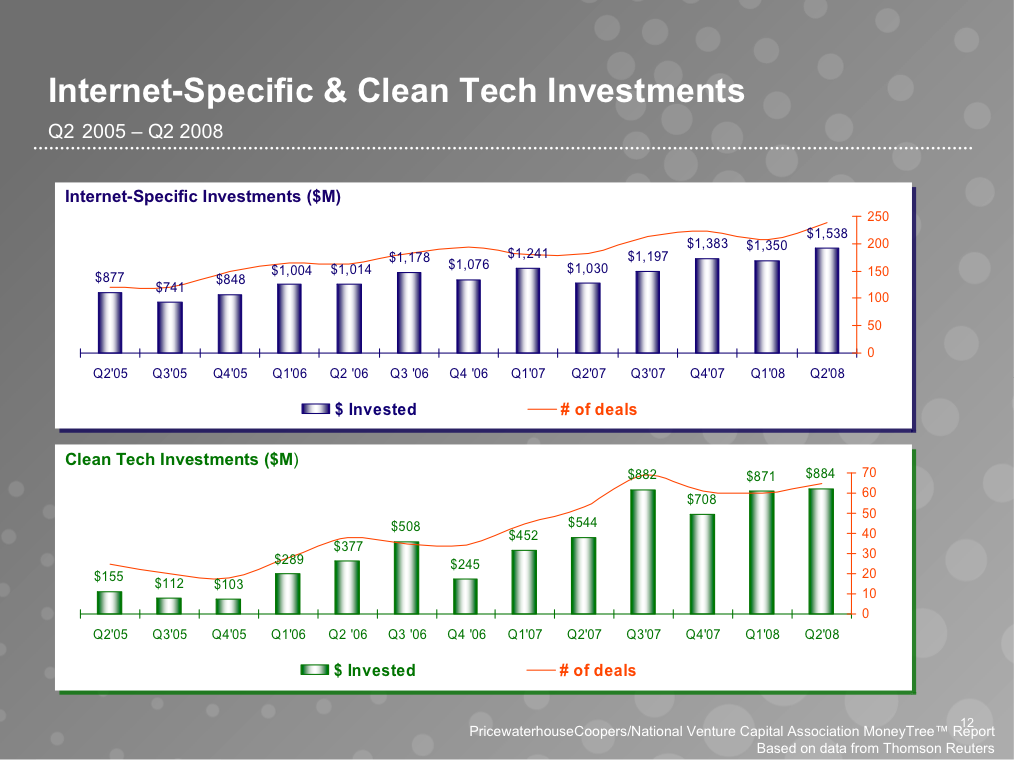

There were a couple of bright spots in the report. Drilling down into Internet-specific and clean tech deals, VC optimism seems to be holding for now. They invested $1.5 billion in Internet deals, up 14 percent from last quarter. Clean tech financings were pretty much flat at $884 million.

If the IPO and M&A drought continue, it should have a deeper impact on current funding levels. But there is usually a lag period between the former going down and VCs waking up to the fact that the environment has changed (the two have been linked historically, despite current investments having a five-to-seven year horizon).