June promises to be an interesting month for Yahoo. The company filed it’s proxy statement yesterday, setting the date for its annual shareholder meeting on August 1. Activist shareholder Carl Icahn, who has already proposed his own alternate slate of board members, is now also calling for CEO Jerry Yang’s head.

Icahn points to a recently unsealed complaint in a shareholder lawsuit that details the lengths Yahoo has gone to squirrel the deal with Microsoft. (The complaint can be downloaded here). He tells the NYT:

I don’t think anybody ever understood the magnitude of what Yahoo did to do avoid making a deal, In my opinion, you might have to get rid of Jerry and part of the board to bring back Microsoft.

What particularly galls him is the employee retention plan Yahoo put into place after Microsoft made its bid, which could have ended up costing Microsoft as much as $2.1 billion if its $31-a-share bid had been accepted (the retention plan would have cost up to $2.4 billion at $35-a-share). Microsoft was willing to shell out $1.5 billion for the retention plan. (Another tidbit from the unsealed complaint, Microsoft had offered $40 a share for Yahoo in January, 2007, which then-CEO Terry Semel turned down). The annual shareholder meeting should be fun.

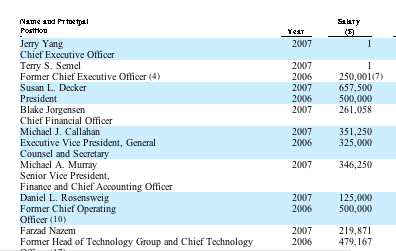

Icahn may want to get rid of Yang, but he is not going to find a less expensive CEO. According to Yahoo’s proxy filing, Jerry Yang’s salary in 2007 was only $1, and he received no other compensation (he does own 3.9 percent of the company, though). President Sue Decker’s salary alone was $658,000.

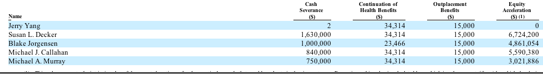

Although, it is not going to cost much to get rid of Yang either. His severance agreement in case of a change of ownership calls for him to get only $2. Sue Decker would get $1.6 million, plus an automatic acceleration of unvested equity and options worth another $6.7 million. If you add up the severance of the top five officers, including the value of accelerated options, it would come to almost $25 million.

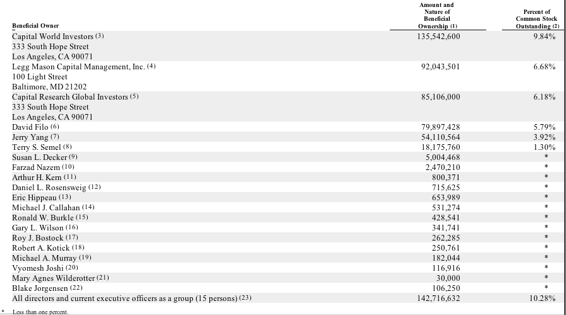

Will Icahn’s sword rattling do him any good? Microsoft has already formally walked away from the deal. It almost surely would come back to the negotiating table if shareholder’s replaced Yahoo’s board, but it may no longer feel it needs to offer $31 a share if that happens. Can it happen? Icahn owns about 4 percent of Yahoo, and is buying up more (perhaps another 4 percent). He’s rallied support from corporate raider pals like T. Boone Pickens (who owns at least 10 million shares, just under 1 percent) and hedge fund investor John Paulson (who owns 50 million shares, which is another 4 percent). So that is only 9 to 13 percent of the voting shares so far.

Icahn needs to get Yahoo’s two largest shareholders on board: Gordon Crawford of Capital Research and Management and Bill Miller of Legg Mason. As of May 7, according to the proxy, Crawford controlled 16 percent of Yahoo’s shares and Miller controlled another 6.7 percent. Add all of that up, and that’s 32 to 36 percent of the shares—still not enough, but getting close. Yahoo insiders, including founders Yang and David Filo, control only 10 percent of the shares. (Click on the table below to see a larger image):