The Kindle, Amazon’s ugly but useful ebook reader that launched in November 2007, may be a burgeoning hit, says Citigroup Analyst Mark Mahaney. Citi expects Amazon to generate between $400 million and $750 million in revenue from the Kindle by 2010, or 1% – 3% of Amazon’s total revenue.

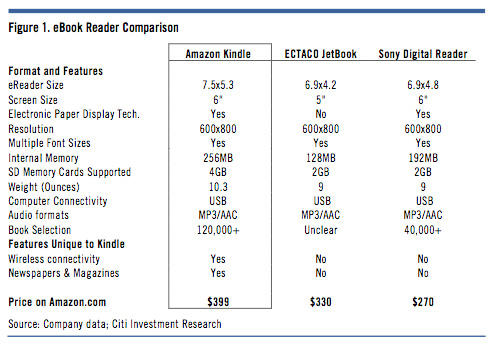

The key points of differentiation with the Kindle and competing devices is the fact that books and other content is delivered to the Kindle wirelessly and that the Kindle has the largest book selection by a significant margin (more than 120,000 books, magazines, newspapers, and blogs, including 98 of 112 current New York Times Best Sellers). Mahaney also points out that the Kindle has more memory than competitors, and supports newspapers, magazine and blog subscriptions. See Mahaney’s comparison chart below for additional details:

Mahaney points to slim public data about Kindle sales to date in making his predictions:

How Is Kindle Doing So Far In The Marketplace?

Our ability to answer this question is very limited. Amazon is the sole retailer of the Kindle and it has disclosed no information about its sales other than to say

that it sold out in the first 5 1⁄2 hours. But we have pieced together four different clues to gain a sense of Kindle’s traction.First, we note that Kindle has consistently been ranked among Amazon’s Bestsellers in its Electronics category. Ahead of the Apple iPod Nano, the Garmin GPS Navigator, and the Canon Powershot Digital Camera.

Second, we note that the Kindle has received a very large number of customer reviews. Per the exhibit below, we note that Kindle has received more customer

reviews than any of the other Top 10 Bestselling items in Amazon’s Electronics category – 2,537 reviews as of May 12th – vs. 663 for the Apple iPod Nano 4

GB Silver (3G), the #2 Bestseller. This is in part an unfair comparison. Kindle is a new product sold only on Amazon.com, while there are numerous versions of the iPod, and they are sold by numerous retailers. But still, the volume of reviews does indicate material traction for the Kindle.Third, we see that the quality/tone of the customer reviews the Kindle is receiving is relatively positive. Below we compare the Star Rating Diffusion – 5 Stars vs. 4 Stars vs. 3 Stars etc… – for each of the Top 10 Bestselling Electronics Items on Amazon. What we see is that the Kindle actually receives fewer high scores than the other Bestsellers – 69% of its reviews are 4 or 5 Stars vs. an average of 80% for the other items. And it receives more low scores than the other Bestsellers – 22% of its reviews are 1 or 2 Stars vs. an average of 13% for the other Items. But for a Version 1 of a product “competing” against a several times iterated leading consumer electronics item like the iPod, a 69% Star 4 or 5 rating is relatively positive.

And fourth, we note that the most reviewed Customer Review of Kindle (“Why and how the Kindle changes everything” by Steve “eBook Lover” Gibson) has been reviewed by at least 27,000 people. Specifically, as of May 13th, 26,931 have read Steve Gibson’s review and actually commented on it by pressing the Yes or No button when asked if the review was helpful. And logically, there would be more people who read the review and didn’t bother to vote, although the voting step is hyper-easy. We believe that this helps provide something of a proxy for how many Kindles have likely been sold. We’d peg the number as somewhere between 10,000 and 30,000 Kindles sold to date.

Citi took this indirect sales data and built a model based on the adoption curve of the iPod “Here’s what’s known. Launched in CQ4:01, the iPod went from 129,000 unit sales in its first quarter to becoming a mass market phenomenon, with a current installed base of approximately 100MM.”

They apply similar adoption rates to the Kindle that the iPod saw (starting at a much lower base: 129,000 iPods v. 10,000 – 30,000 Kindles in first three months on the market) and then discount the entire model by 50% – 75% to hedge risk in coming up with the three year revenue model. “So perhaps, if Amazon executes right with its Kindle product and marketing strategy, the iPod analogy for the Kindle won’t be too far stretched,” Mahaney says.

About half the projected revenue is from Kindle sales, half from book sales after purchase.

What’s our take? I was down on the Kindle when it first launched but quickly fell in tepid like with it once it was in my hands for a few weeks. But then John Biggs at CrunchGear borrowed it from me in January, apparently permanently. I’ve learned to live without it. The biggest issue I had with it, once I got the hang of it, was accidental page turns. I’m still buying a lot of normal books, but when I get my Kindle back I’ll happily switch back to the ebook world.