Citigroup Internet Analyst Mark Mahaney (our interview from last week is here) updated his Yahoo guidance today based on the Microsoft bid withdrawal over the weekend.

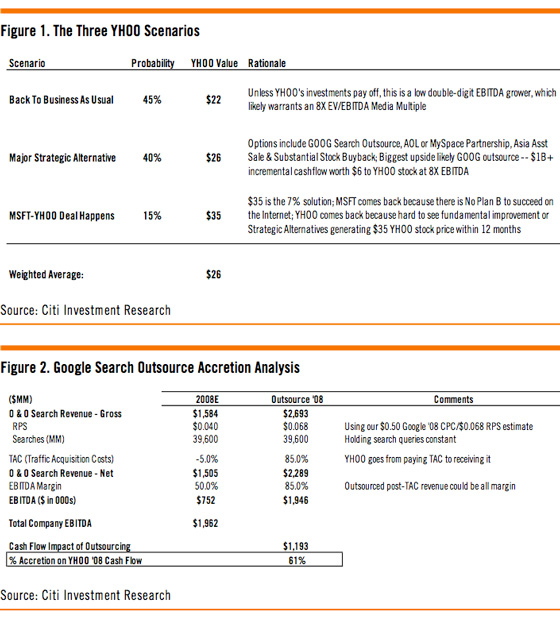

He sees Yahoo’s stock going to $22 if they continue with “business as usual” and don’t find a partner. This is 45% likely, he says. He gives a 40% chance that Yahoo pursues a major strategic alternative such as a Google outsourcing, partnership with AOL or MySpace, stock buyback, sale of Asian assets, etc. A Google outsourcing deal brings $1 billion of more in increased cash flow and adds $6 to Yahoo’s stock, he says.

He’s also saying that an eventual combination with Microsoft is still 15% likely. Microsoft may come back to the table, he says, because “there is No Plan B to succeed on the Internet” (I agree). The weighted average is a $26 stock price. Yahoo is currently (noon PST) trading at $24, down about 15% from Friday. It started the day down 20%.

Mahaney’s full chart is below. I’ve also added his top level analysis of a Google outsourcing deal. Search revenue would grow from $1.6 billion to $2.7 billion (moving from 4 cents a click to 7 cents).

Compare Mahaney’s $26 price guess to the Fred Wilson’s informal crowdsourcing approach, which came in at $22. If the markets stay steady, the real price is nearly exactly the mid point between the two.