Web hosting provider Rackspace filed for an initial public offering with the SEC last night, as we predicted it would. The company will try to raise $400 million, and it intends to set the IPO price through an auction, much like Google did. The underwriters are Goldman Sachs, Merrill Lynch, Credit Suisse, and WR Hambrecht & Co. (the leading proponent of such IPO pricing). Pricing through an auction is designed to make sure the company raises the most money possible instead of giving up a first-day pop to investors who are allocated shares by the investment banks doing the deal. Shares will still be allocated to such clients, but anyone who bids beforehand in the auction at or above the eventual IPO price will also get shares. All in all, it is a much more efficient way to price an IPO and more companies should do it.

Web hosting provider Rackspace filed for an initial public offering with the SEC last night, as we predicted it would. The company will try to raise $400 million, and it intends to set the IPO price through an auction, much like Google did. The underwriters are Goldman Sachs, Merrill Lynch, Credit Suisse, and WR Hambrecht & Co. (the leading proponent of such IPO pricing). Pricing through an auction is designed to make sure the company raises the most money possible instead of giving up a first-day pop to investors who are allocated shares by the investment banks doing the deal. Shares will still be allocated to such clients, but anyone who bids beforehand in the auction at or above the eventual IPO price will also get shares. All in all, it is a much more efficient way to price an IPO and more companies should do it.

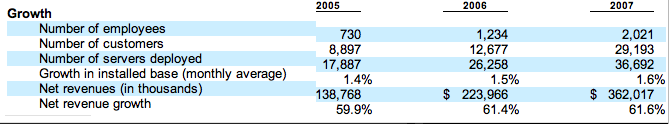

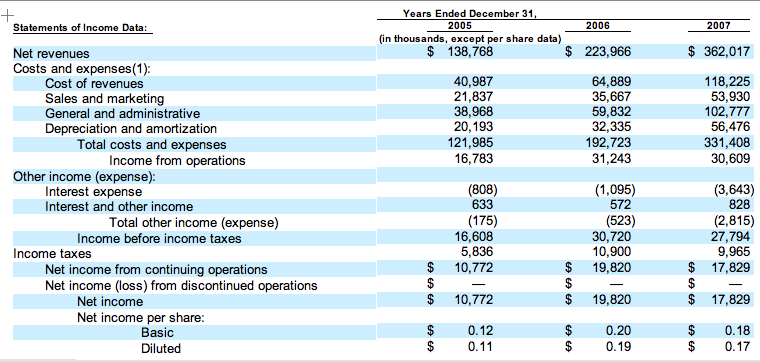

With the filing we also get a clearer picture of Rackspace’s business and financials. Its revenues grew 62 percent last year to $362 million, but it posted net profits of $17.8 million, which were down 10 percent from the year before. Cash flows from operations, though, remained healthy at $105 million last year, up from $61 million in 2006. (Click on the table below for a bigger image and more data):

The decline in profits was because the company spent a lot more staffing up and spending more on sales and marketing. About half of the $53 million increase in its cost of revenues last year was attributable to the fact that it nearly doubled the number of employees to 2,021 (of that, data center employees went from 576 to 994, and sales and marketing headcount went from 224 to 353). Servers, software licensing costs, bandwidth, power and rent made up most of the rest of the increase.

Another interesting tidbit: that truck accident that took down one of its data centers in Texas last November cost the company $3.4 million in credits to customers.

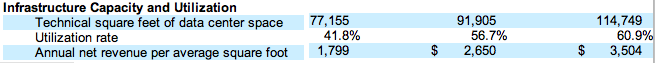

At the end of the year, it had 29,193 customers, compared to 12,677 the year before. But nearly all of that growth was due to its acquisition of Webmail.us (i.e., they are hosted e-mail customers, not hosted Website customers). Rackspace has 36,692 servers across seven data centers, 114,749 square feet of data center space, with a 61 percent utilization rate. The company makes $3,504 a year per square foot, a number that has been growing nicely, illustrating that Web hosting is a scale business with increasing returns the more servers that can be rented out.