Microsoft just announced its March quarterly earnings. As expected, CFO Chris Liddell did not budge on Microsoft’s stance towards raising its bid for Yahoo. During the conference call he made the following statement about Yahoo, which you can listen to here courtesy of EarningsCast (I’ve bolded the more interesting parts):

Microsoft just announced its March quarterly earnings. As expected, CFO Chris Liddell did not budge on Microsoft’s stance towards raising its bid for Yahoo. During the conference call he made the following statement about Yahoo, which you can listen to here courtesy of EarningsCast (I’ve bolded the more interesting parts):

With or without a Yahoo combination, Microsoft is focused on the online advertising market, which is expected to double by 2010 to $80 billion. Although Yahoo would accelerate our efforts, we have an existing strategy that is already centered on three key pillars: drive innovation on search, increase value to advertisers and publishers, and increase user engagement across our MSN and Windows Live properties.

We have an extremely talented engineering team, a great portfolio of advertiser and publisher tools, and key assets in information content, communications, and social networking. Lastly, We are committed to compete in online advertising through organic investments, partnerships, and acquisitions such as aQuantive and Rapt.

With respect to Yahoo we have been clear, as evidenced in the size of our offer premium, that speed is of the essence for the deal to make sense. Unfortunately the transaction has been anything but speedy, as has been characterized by what appear to be unrealistic expectations of value. Our initial offer was an extremely generous, more than 100 percent premium for Yahoo’s core business. Our view on value is shaped by the longterm value and we plan to stay disciplined in our approach,

The strongest argument that we should increase our bid because we can afford to is not one I favor. We have yet to see tangible evidence that our bid substantially undervalues the company. In fact we see the opposite. Yahoo continues to lose search share and profitability continues to decline year on year. The results they announced on Tuesday were in line with the guidance they gave on their last earnings call on January 29th, after which their stock price closed at $19.05 and Wall Street analysts consensus on value was significantly decreased.

As outlined in our recent letter to the Yahoo board, unless we make progress with Yahoo towards an agreement by this weekend we will reconsider our alternatives. We will provide updates as appropriate next week. These alternatives include taking our offer to Yahoo shareholders or to withdraw our proposal and focus on other opportunities, both organic and inorganic. We can’t go in the Q&A session beyond what I just said.

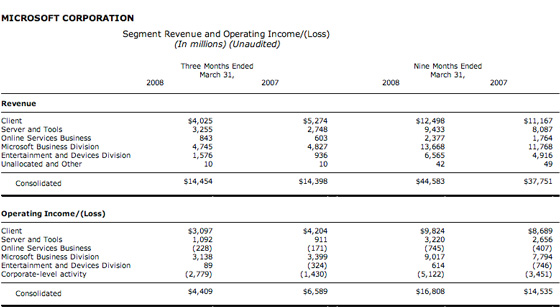

As far as Microsoft’s quarter went, revenues were flat at $14.5 billion and operating income declined 33 percent to $4.4 billion. The drop in operating income was largely due to $1.7 billion in deferred revenue that the company recognized last year at this time related to the release of Windows Vista. Earnings per share came in at $0.47, about two cents above consensus, but still down from $0.51 last year.

Some highlights from the different operating segments:

—Client revenue (Windows) was down 24 percent to $4B, but it still brought in $3B in operating income.

—Server revenue was up 16 percent to $3.3B, with operating income of $1B

—Microsoft Business held steady at $4.7B in revenues, and operating profits were slightly down to $3.1B

—Entertainment and devices (Xbox, Zune, etc) saw a 68 percent rise in revenue to $1.6B, and managed to eke out an operating profit of $89 million.

—Online services revenue was up 40 percent to $843 million, but that business posted a larger operating loss of $228 million.

And here are the slides: