You didn’t really think that Silicon Valley would be immune to the general convulsions in the overall economy, did you? I am not sure it is as bad as the NYT gleefully makes it out to be, but there is growing evidence of a tech slowdown, including M&A deals and IPOs drying up, slower job growth, signs of weakness on Web advertising, cautious corporate IT spending, and rising costs for companies that offshore their labor force due to the decline of the dollar.

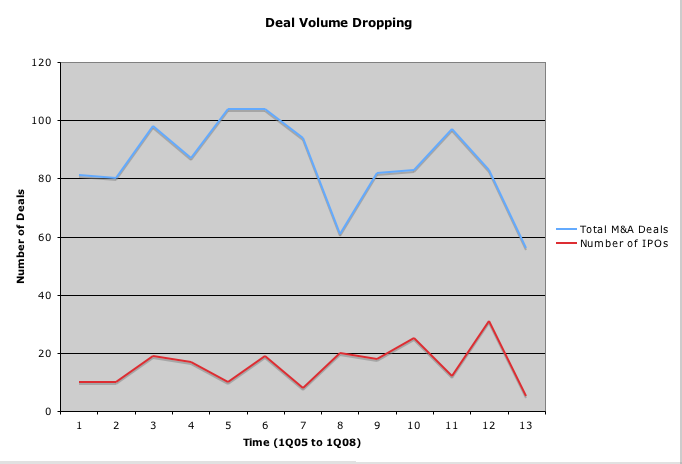

The latest numbers from the National Venture Capital Association show that the startup economy was starting to feel some pain in the first quarter. Venture-backed M&A deals hit the lowest level in a decade, with only 56 deals announced in the first quarter, down from 83 in the fourth quarter of 2007. The IPO market also dried up, with only five venture-backed IPOs, compared to 31 in the fourth quarter of 2007. (See chart above). The average amount raised for each IPO was $56.6 million (down 42 percent quarter-over-quarter). And the average M&A deal size was $124.6 million (down 40 percent quarter-over-quarter)

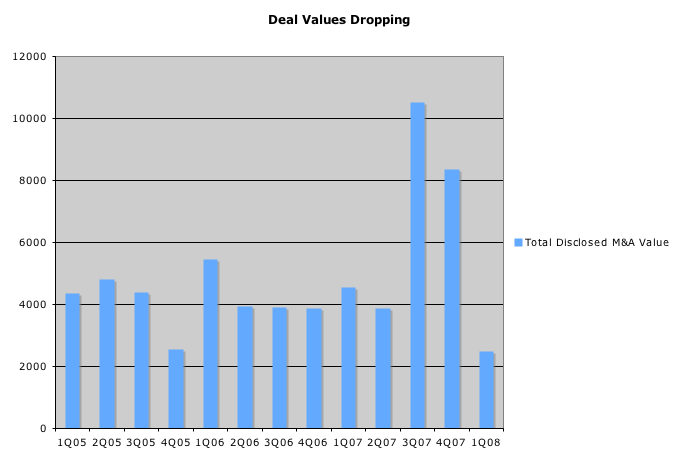

The overall value of disclosed M&A deals in the first quarter was $2.5 billion, compared to $8.4 billion in the fourth quarter of last year:

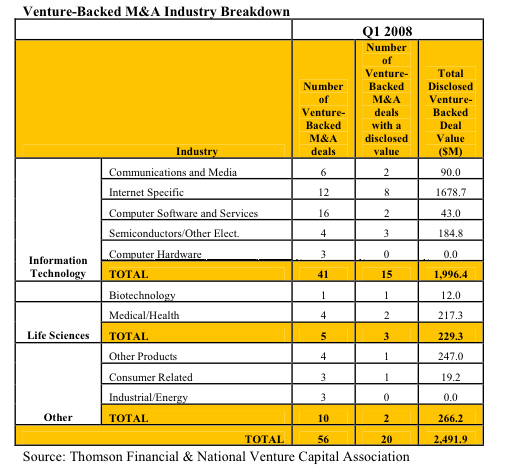

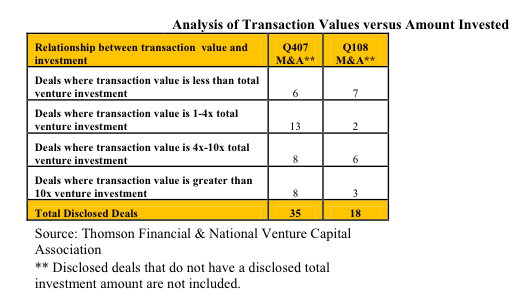

Diving a little deeper, Internet deals still dominated the first quarter of 2008, with 12 deals valued at $1.7 billion. But the number of deals where investors are taking a loss is going up, and the number of deals with outsized returns of 4 times or more of the amount of venture capital invested is going down. Are our readers in Silicon Valley feeling the effects of the downturn? Please share in comments.