Zillow, the site where you can find pricing estimates and other info about houses around the United States, aims to disrupt the online lending market with the launch of its Mortgage Marketplace.

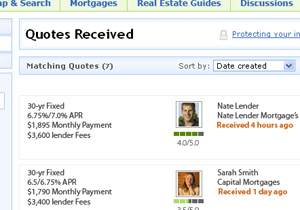

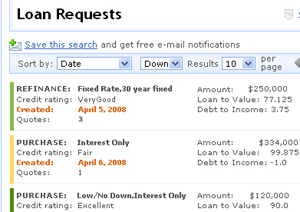

The marketplace is a free service that hooks lenders up with borrowers. It works very much as Zicasso does for travelers (see our review of that service here). Borrowers submit just the essentials – what type of loan they need, where they’re located, their estimated property value, their credit history, etc – without divulging any of their contact info. Then certified lenders make offers that can be compared side-by-side. It’s up to the borrower to reach out and contact those lenders, not the other way around as it is with services like Lending Tree.

Zillow cites a Harris Interactive study showing that it’s more important for borrowers to keep their contact info private than to find the best rates. Apparently lenders are a bit too eager to sell you on a deal after they know how to find you. So the main advantage of this marketplace lies in protecting borrowers’ identities and tipping the balance of power into their favor.

There are other advantages to the system as well. Borrowers can rate lenders and leave comments about them so that others can make better decisions. The extra transparency also lets lenders know what types of offers they are competing with, which could lead to more competitive deals. That’s okay with lenders, though, since they’re gaining access to a larger market for which to make their offers.

According to the company, Zillow attracts about 5M unique visitors monthly, 1/5 of which are looking for a loan and 2/3 of which are looking to buy or sell a home. We’ve also been told that 1 in 3 professional lenders visit Zillow every month. This traffic is therefore a natural fit for a service like this, which shouldn’t have a problem gaining traction.

Some other fun facts about Zillow: of the 90m homes in the US, 80M are listed in Zillow and 70M have estimated prices (“zestimates”). A full 45% of the 90M total homes have been looked up on the site; in San Francisco that percentage is around 90%.