The battle over the future of CNET continues. This morning the Jana consortium, which announced an attempt to take control of the CNET board of directors in January, published a website and white paper (embedded below) to support their effort.

The battle over the future of CNET continues. This morning the Jana consortium, which announced an attempt to take control of the CNET board of directors in January, published a website and white paper (embedded below) to support their effort.

Jana and its co-investors now own 14.9% of CNET, plus another 8% in non-voting derivatives. Their primary goal is to get voting control of the board to push through a broad agenda to reform the ailing company. But that hasn’t gotten them much face time with CEO Neil Ashe and the rest of the executive team. From reports, CNET has treated Jana as an outsider, despite the fact that they are the largest or second largest shareholder in the company. CNET sued to throw out Jana’s claims for board seats based on a technicality. That suit was dismissed quickly, but an appeal was filed last week.

At this point, the CNET team is trying to firm up the financial status of the company in advance of their annual shareholder meeting in June to have any chance of staying in control (and keeping their jobs). Jana, meanwhile, will be attempting to win points with the other stockholders to get their votes for the board slate they are proposing at that meeting.

The CNET board currently consists of eight directors. Two are up for election at the upcoming meeting (Peter Currie, Elizabeth Nelson). Jana wants to replace those two directors, and add five new seats, giving they 7 of 14 directors and voting control of the board.

The message Jana is sending to the CNET stockholders is straightforward and blunt:

Despite premiere brands and content, CNET Networks Inc. (“CNET”) has consistently underperformed peers and destroyed enormous shareholder value. We believe there is still time to reverse course and unlock value, but in order to do so CNET must undertake transformative change to strengthen its core assets and move from its “Web 1.0” roots to the modern Internet industry. We believe CNET’s current leadership has failed to offer shareholders any evidence that it possesses either the necessary sense of urgency or the experience and expertise needed to lead this change successfully.

and

Despite owning leading web properties, over the past few years CNET has consistently underperformed its peers due to a failed strategy and an inability to proactively seize upon new opportunities and challenges in an effective manner. The majority of the current Board has overseen a 45% decline in shareholder value since 2005.

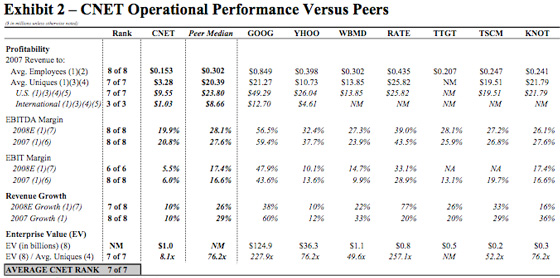

The white paper is an even broader condemnation of the management team. It begins with “The leadership of CNET…has presided over massive value destruction…CNET’s current leadership now claims it can reverse course and begin creating shareholder value, but we believe they have offered no evidence that they can do so.” They also point to data showing a three year, 25% decline in CNET stock v. a 40% gain in the Morgan Stanley Internet Index.

Jana’s plan: Bring in “new leadership” to CNET to execute on a new strategy focused on “strengthening core assets.” The plan is centered on improving advertising technology and organization, improving navigation and SEO strategies, and leveraging social media to boost growth. They also call for an improved content management system and significant cost reductions. Revenue per employee in 2007, they say, was dead last compared to CNET’s peers.

Starting on page 31 of the document below Jana also provides a timeline of events showing an increasingly hostile relationship between the parties.