When AOL bought Bebo for $850 million last week, CEO Randy Falco and COO Ron Grant believed the social network would help save AOL from its downward spiral. Social networks are where pageviews are generated these days, and AOL’s own attempt to turn AOL Instant Messenger into one (via Aim Pages) was a dud on arrival. Bebo, with 22.9 million unique visitors in February and 10.3 billion pageviews (per comScore), was growing and it was for sale. Even though AOL is trying to transform itself into an advertising network, it makes much higher margins on the ads it places on its own pages. The formula for its business is pretty simple: Unique visitors X page views = advertising inventory. If social networks are the future of the Web, AOL needed to own one.

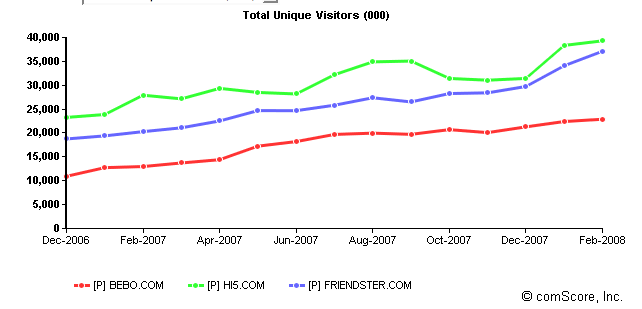

But was Bebo the right one, and did AOL pay too much for it? Those are questions that other AOL executives below Falco and Grant are asking themselves, reports Silicon Alley Insider. The concerns of the senior executives who actually run AOL (and reportedly were not consulted on the top-secret acquisition) include: the general difficulty of making money placing ads on social networks (see Google’s missed quarter), “flattening traffic growth at Bebo” (see chart below), overly-rosy revenue projections for Bebo that might have been three times too high, and the likelihood of losing Bebo’s most talented employees (the founders are already out of there).

From my own sanity-checks with sources, there is definitely the sense that AOL was not Bebo’s first choice. Initially, it was aiming for a valuation above $1 billion. But then the ground started falling out beneath it, and AOL’s $850 million offer started to look real good. AOL was a desperate buyer. Even if it bargained Bebo down on price, it may still have paid too much. Bebo’s growth is indeed flattening relative to other global social networks like Hi5 or Friendster. And while social networks generate a lot of pages, they are not yet particularly valuable pages.

There is a silver lining here, though. If AOL can use its targeted advertising assets (Advertising.com, Quigo, Platform A) to make that Bebo inventory pay out, it will surprise everybody. And that will be good for Platform A because it then will be able to grab more advertising business from other social networks. (That is, if New York State does not outlaw targeted advertising before then). The likelihood of that happening is not great, but AOL employees need at least a glimmer of hope to keep showing up to work every morning. (I do what I can).