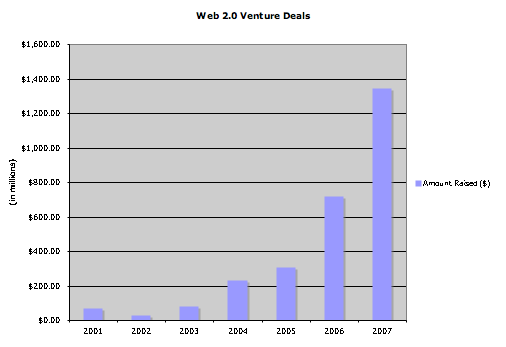

Dow Jones VentureSource put out some data on Web 2.0 deals in the U.S. earlier this week that I’ve put together into these charts. The first one above shows how much money has been invested in Web 2.0 startups so far this decade. In 2007, venture capital poured into Web 2.0 companies at a record pace—$1.34 billion. That was up 88 percent from the $716 million invested in 2006.

But did Web 2.0 deals peak last year? Take out the $300 million raised by Facebook, and the amount invested was up only 46 percent, a marked slowdown from the 132 percent dollar growth the year before. (The amounts charted above, starting with 2001, are $68 million, $29 million, $79 million, $232 million, $716 million, and $1.343 billion)

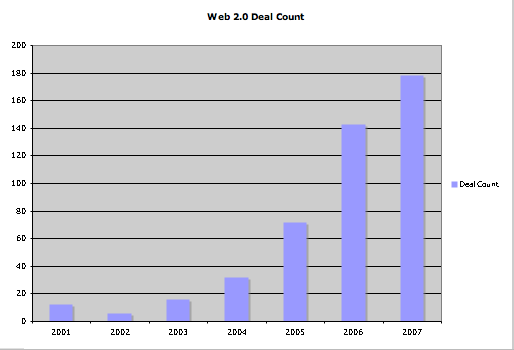

The growth in the number of deals is also slowing. Last year, there were 178 Web 2.0 deals in the U.S. That was up only 25 percent, after doubling every year for the previous four years. And in Silicon Valley last year, the number of deals actually dropped from 74 to 69.

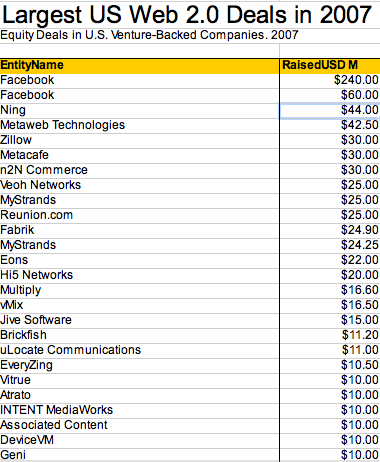

In 2007, the median deal size was $5 million, up 22 percent. And the median pre-money valuation was $10 million, up 66 percent (from $6 million in 2006). Both deal size and valuation for Web 2.0 companies remained below the average VC deal across all industries ($7.6 million and $16 million, respectively)

Here is a list of some of the biggest venture financings of 2007, including ones for Facebook, Ning, Zillow, Veoh, MyStrands, and Hi5. Slide’s $50 million isn’t included because that was in 2008. Hey, maybe things haven’t peaked after all.